.webp)

Autore

Jonathan Hobbs, CFA

Data

09 Jul 2025

Categoria

Market Insights

A Closer Look at the New IncomeShares ETP Range

Il tuo capitale è a rischio se investi. Potresti perdere l’intero investimento. Consulta l’avviso completo sui rischi qui.

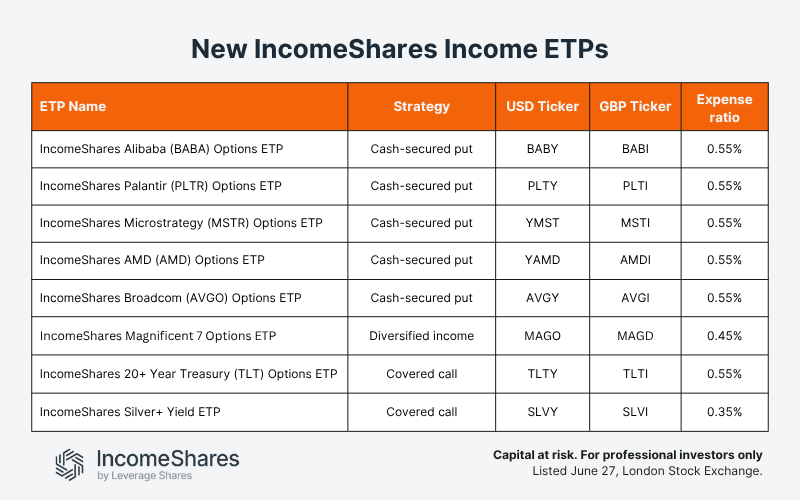

On June 27, IncomeShares listed eight new exchange-traded products (ETPs) on the London Stock Exchange – bringing our total ETP range from 11 to 19. The launch of these new products happened shortly after IncomeShares reached $50 million in assets under management in mid-June.

IncomeShares ETPs aim to earn monthly income by selling options on their underlying assets. The eight new ETPs can be split into three groups:

- Five single-stock ETPs

- One Magnificent 7 diversified income ETP

- Two asset class ETPs (silver and long-dated US Treasury bonds)

Single-stock ETPs

IncomeShares launched five new single-stock ETPs for Alibaba, AMD, Broadcom, MicroStrategy, and Palantir. These are growth-focused stocks that tend to be volatile and don’t usually pay high dividends. This may make them a good fit for options income strategies.

Each new single-stock ETP follows the same actively managed strategy. The ETPs aim to generate monthly income by selling put options on their respective individual stocks – while holding cash or shares depending on market conditions.

Because the strategy can involve buying shares when prices drop, the ETP may retain partial upside exposure to the stock – especially during rebounds. Strike prices and allocations adjust dynamically based on the stock’s volatility. This gives investors another potential way to earn income from individual stocks – without relying on dividend payouts.

All five ETPs have a total expense ratio (TeR) of 0.55%. That means investors pay a fee of 0.55% per year based on the value of their investment. The fee covers all ongoing costs and gets priced into the ETP each day.

Magnificent 7 Options ETP

The Magnificent 7 Options ETP provides exposure to seven of the world’s biggest tech stocks through a single product.

It invests in a basket of seven IncomeShares single-stock ETPs. Each underlying ETP aims to deliver monthly income while retaining some exposure to the upside in its underlying stock. Each ETP is weighted equally in the basket and rebalanced twice a year. The TeR is 0.45%.

Over time, some ETPs may grow faster than others — either by earning more income or gaining more through equity exposure. Rebalancing brings each position back to equal weight. That means trimming what’s gone up and topping up what’s lagged. In effect, the ETP sells high and buys low — keeping the mix better balanced over time.

Asset class ETPs: TLT and Silver

The final two new ETPs provide exposure to asset classes — not stocks.

The IncomeShares 20+ Year Treasury Options ETP invests in long-dated US government bonds (via the iShares TLT ETF) and sells weekly call options to aim to generate income. It may also earn interest from the bonds and from uninvested cash. The strategy gives investors partial upside exposure to TLT, while aiming to deliver a monthly return from premiums and yield.

The IncomeShares Silver+ Yield ETP holds the iShares Silver Trust (SLV) and sells call options on it. The goal is to collect monthly income from option premiums, while retaining some upside exposure to the silver price.

The TeR is 0.55% for the TLT ETP and 0.35% for the Silver+ Yield ETP.

Tax Efficiency

All IncomeShares ETPs are domiciled in Ireland, a jurisdiction widely regarded for its tax-friendly structure. Unlike some other income-paying ETPs, IncomeShares products are not subject to US withholding tax at source and do not otherwise withhold amounts on distributions.

The new IncomeShares range will also be cross-listed on the Boerse Frankfurt in the coming weeks.

Il tuo capitale è a rischio se investi. Potresti perdere l’intero investimento. Consulta l’avviso completo sui rischi qui.

Prodotti correlati:

Strategia

Basket of Income-generating ETPs

Rendimento di

distribuzione

49.36%

Strategia

Covered Call

Rendimento di

distribuzione

11.90%

Strategia

Covered Call

Rendimento di

distribuzione

18.40%

Strategia

Cash-Secured Put + Equity

Rendimento di

distribuzione

70.37%

Strategia

Cash-Secured Put + Equity

Rendimento di

distribuzione

90.44%

Strategia

Cash-Secured Put + Equity

Rendimento di

distribuzione

138.17%

Strategia

Cash-Secured Put + Equity

Rendimento di

distribuzione

93.71%

Strategia

Cash-Secured Put + Equity

Rendimento di

distribuzione

65.58%