.webp)

Autor

Jonathan Hobbs, CFA

Fecha

02 Sep 2025

Categoría

Market Insights

Understanding Put-Selling Strategies

Su capital está en riesgo si invierte. Podría perder toda su inversión. Por favor, consulte la advertencia de riesgos completa aquí.

Options can seem complex, but put-selling is one of the more straightforward strategies to understand. It aims to generate income and gives investors a way to potentially enter stocks at lower effective prices.

What is put-selling?

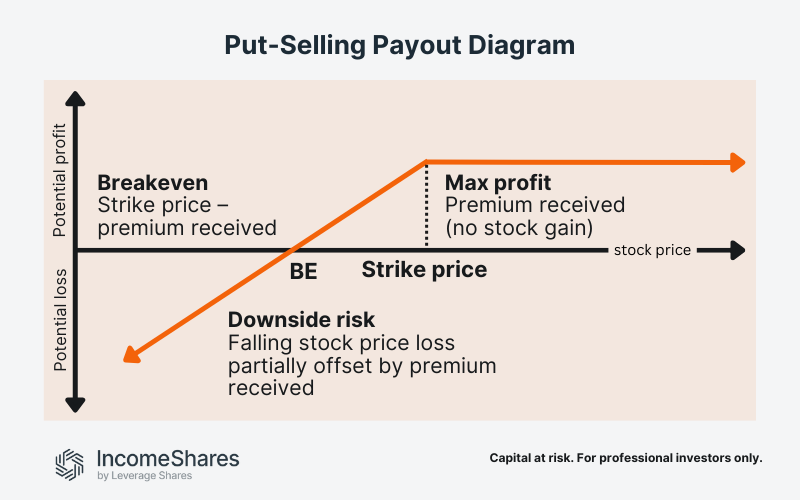

Selling a put option means agreeing to buy a stock (or other asset) at a fixed “strike price” if the buyer exercises the option. In return, the put seller collects an upfront premium – the price of selling the put option. That premium is income, which the seller keeps regardless of the outcome.

Think of selling a put as offering insurance. The option buyer pays a premium to guarantee a “worst-case” selling price if the stock drops. The seller provides that guarantee to buy the stock, and keeps the cash up front to buy it.

How the strategy works in practice

There are two main outcomes when selling puts:

Stock stays at or above the strike price. The option expires worthless, since the put buyer has no reason to sell the stock. The seller keeps the full premium as profit. (If the stock finishes exactly at the strike, the put normally expires worthless too, so this falls into the same outcome.)

Stock falls below the strike price. The option buyer may sell the stock at the higher strike price. The seller must buy the stock at that level, but the premium received lowers the effective cost.

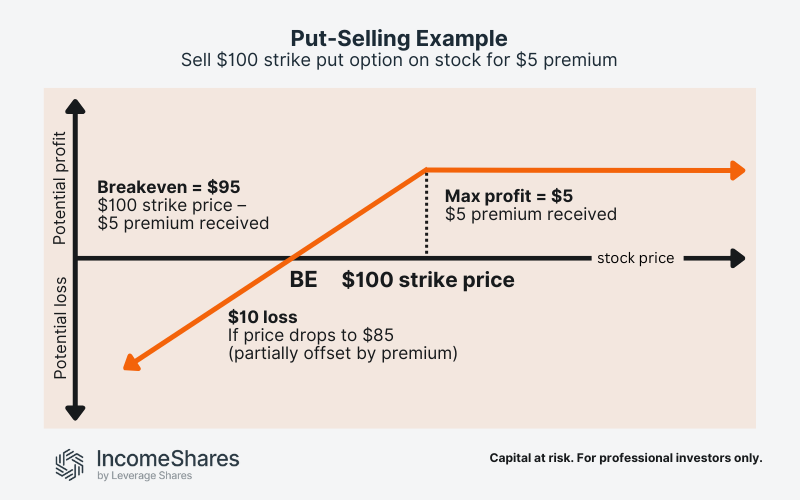

For example, you sell a $100 strike put for a $5 premium. If the stock stays above $100, you keep the $5. If it drops to $95, you buy the stock for $100, but effectively pay $95 after receiving the premium.

If the stock then falls further – say to $85 – you still paid $95, so the position is now down $10 per share. Keep in mind that simply buying the stock at $100 (without selling puts) would mean a $15 loss if it dropped to $85. By selling the put, the premium reduces that loss to $10 – showing how option income may help cushion downside.

Benefits and risks of put-selling

The main benefit is income from option premiums. Put sellers may earn that income repeatedly if options expire without being exercised by the buyers. Selling puts can also be a way to buy stocks at lower effective prices. Some investors use it as a disciplined entry method when they’re happy to own the stock at a certain level.

But the risks are clear. Premium income is capped, while losses can grow if the stock falls sharply. Assignment means taking ownership of shares in a downturn, with the premium only partly offsetting the loss. Put-selling strategies tend to be the most profitable when markets are flat or slightly bullish. When prices are sliding lower, however, they may only help cushion the downside rather than prevent losses.

How IncomeShares applies put-selling

IncomeShares uses put-selling as part of its income-focused strategies. The approach appears both in our cash-secured put plus equity products and zero-days-to-expiration (0DTE) put-write strategies.

Each of these ETPs (exchange-traded products) combines two core elements:

Equity exposure to capture some upside if markets rise.

Systematic put-selling backed by cash, aiming to generate regular income and potentially acquire shares at a discount when markets dip.

This mix provides investors with exposure to a rules-based strategy that may balance income generation with ongoing stock exposure – without the need to trade options directly.

Key takeaways

Put-selling generates income through option premiums and may reduce entry costs.

Premiums are limited, but downside exposure is not.

IncomeShares integrates put-selling into listed ETPs through its cash-secured put plus equity and 0DTE put-write strategies.

Su capital está en riesgo si invierte. Podría perder toda su inversión. Por favor, consulte la advertencia de riesgos completa aquí.

Productos Relacionados:

Estrategia

Put garantizado con efectivo + Acciones de TSLA

Rendimiento de

Distribución

53.69%

Estrategia

Put garantizado con efectivo + Acciones de NVDA

Rendimiento de

Distribución

56.85%

Estrategia

Put garantizado con efectivo + Acciones de Amazon

Rendimiento de

Distribución

56.03%

Estrategia

Put garantizado con efectivo + Acciones de Apple

Rendimiento de

Distribución

35.60%

Estrategia

Put garantizado con efectivo + Acciones de Alphabet

Rendimiento de

Distribución

35.12%

Estrategia

Put garantizado con efectivo + Acciones de Coinbase

Rendimiento de

Distribución

84.43%

Estrategia

Put garantizado con efectivo + Acciones de META

Rendimiento de

Distribución

35.76%

Estrategia

Cash-Secured Put + Equity

Rendimiento de

Distribución

71.17%

Estrategia

Cash-Secured Put + Equity

Rendimiento de

Distribución

64.08%

Estrategia

Cash-Secured Put + Equity

Rendimiento de

Distribución

121.25%

Estrategia

Cash-Secured Put + Equity

Rendimiento de

Distribución

70.38%

Estrategia

Cash-Secured Put + Equity

Rendimiento de

Distribución

68.52%