.webp)

Autore

Jonathan Hobbs, CFA

Data

21 Nov 2025

Categoria

Education

US Estate Tax for EU and UK Investors

Il tuo capitale è a rischio se investi. Potresti perdere l’intero investimento. Consulta l’avviso completo sui rischi qui.

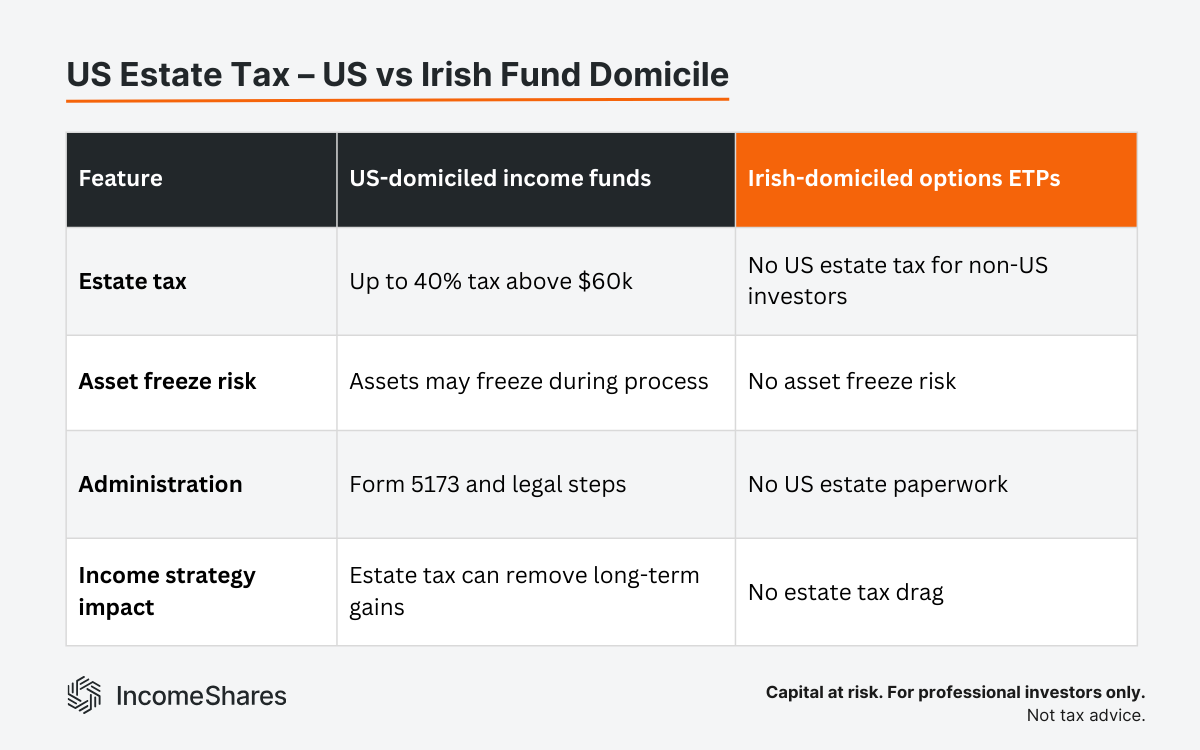

US estate tax sits far outside most investors’ daily thinking. But it can affect long-term outcomes for anyone in the UK or Europe who holds US-based funds. Estate tax applies on death. And it can reach up to 40% for US-based assets above the $60,000 threshold. That could mean up to 40% tax passed on to your heirs.

This guide explains how US estate works, who it affects, and why Irish-domiciled options ETPs can avoid that risk.

What US estate tax means for non-US investors

The US charges an estate tax when a non-US investor dies while holding US-based assets. That includes US-domiciled ETFs or funds, even if the investor lived in London or Berlin.

The exemption is small. Only the first $60,000 of US-based assets is free from estate tax. Anything above that may fall into the US estate tax system.

If that happens, the US may charge up to 40% on the value of those assets. The tax applies before the assets move to your heirs, so it can reduce what your family receives.

There’s also an administrative side. US assets can freeze during the process. That delay can create stress for families and slow down inheritance planning. To release those frozen assets, the executor must request an IRS transfer certificate using Form 5173. This certificate confirms the estate’s US tax position and allows the assets to pass on to your heirs.

Why fund domicile changes the tax outcome

Estate tax depends on where the asset sits. US-domiciled funds count as US-based property. Irish-domiciled funds don’t. That means a non-US investor can hold unlimited Irish-domiciled ETPs without entering the US estate tax system. The assets sit in Ireland, not the US. So Ireland’s rules apply, not America’s.

IncomeShares ETPs are Irish-domiciled. They aim to generate income from selling options on US-listed assets – but the product itself sits in Ireland. Hence, estate tax doesn’t apply. This can reduce complexity, reduce risk for your heirs, and remove the chance of asset freezes.

Putting it together: income products and estate tax

Income strategies often involve long holding periods. Estate tax becomes relevant when investors compound income back into the funds over many years. A 40% tax on US-domiciled funds can undo years of income gains.

Irish-domiciled options ETPs avoid US estate tax. Investors still face normal investment risks, but estate tax isn’t one of them. That difference can support smoother long-term planning for EU/UK investors.

You can also read this article to learn more about US withholding exemptions for Irish-domiciled funds.

Key takeaways

US-domiciled funds can face up to 40% estate tax for non-US investors above $60,000.

Irish-domiciled options ETPs avoid US estate tax because the assets sit outside the US.

Estate tax risk can undo long-term income gains, so fund domicile matters for planning.

Il tuo capitale è a rischio se investi. Potresti perdere l’intero investimento. Consulta l’avviso completo sui rischi qui.

Prodotti correlati:

Strategia

Put garantita da contanti + Azioni

Rendimento di

distribuzione

50.88%

Strategia

Put garantita da contanti + Azioni

Rendimento di

distribuzione

38.25%

Strategia

Covered Call

Rendimento di

distribuzione

12.96%

Strategia

Basket of Income-generating ETPs

Rendimento di

distribuzione

49.20%

Strategia

Covered Call

Rendimento di

distribuzione

11.83%

Strategia

Covered Call

Rendimento di

distribuzione

17.54%