.webp)

Autor

Jonathan Hobbs, CFA

Fecha

19 Aug 2025

Categoría

Market Insights

IncomeShares Distribution Yields in 2025 (So Far)

Su capital está en riesgo si invierte. Podría perder toda su inversión. Por favor, consulte la advertencia de riesgos completa aquí.

The distribution yields of IncomeShares ETPs (exchange-traded products) change each month, depending on strategy performance and market conditions. This article explains how these yields have changed so far this year.

What is distribution yield?

IncomeShares ETPs aim to earn monthly income by selling options on various underlying investments. When an ETP sells an option, the option buyer pays a “premium” to the ETP. That premium is the source of income that the ETP may pay out to investors each month.

To make these distributions easier to compare, the industry uses "annualised distribution yield.” This takes the latest monthly income payout, multiplies it by 12, and divides it the ETP's net asset value (NAV) for that month.

We express the result as a percentage, using the formula below:

Distribution yield (%) = (latest monthly distribution yield × 12) ÷ current NAV × 100

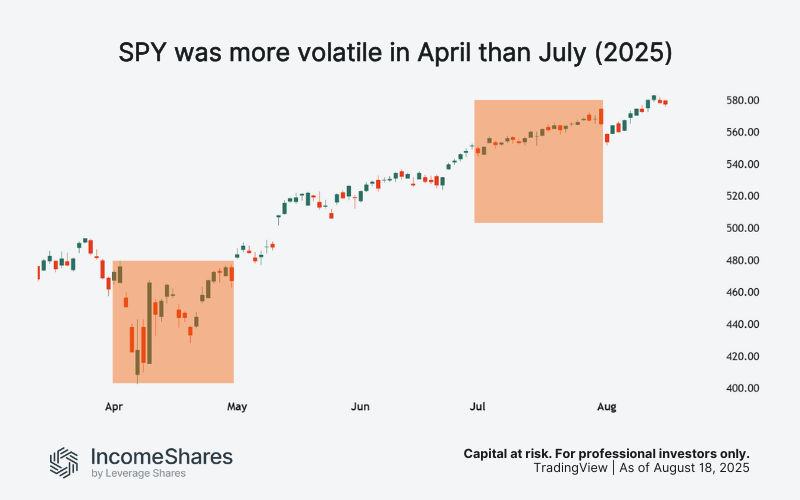

Because the formula annualises just one month’s payout, distribution yields can range widely each month. For example, the IncomeShares S&P 500 Options ETP had an annualised distribution yield of 180.27% in April 2025. But in July, it was 39.86%.

In this example, a lot of that yield difference was down to market conditions. In April, the SPY (the ETP’s underlying investment) was more volatile than in July. Higher volatility typically increases the demand for options, which raises premiums – and hence option ETP income potential.

Over the seven months from Jan through July, the IncomeShares S&P 500 Options ETP averaged 82.36%.

How have IncomeShares' distribution yields changed throughout 2025?

IncomeShares currently offers 19 ETPs that aim to generate monthly income by selling options on single stocks, US stock market indexes, commodities, and US Treasury bonds.

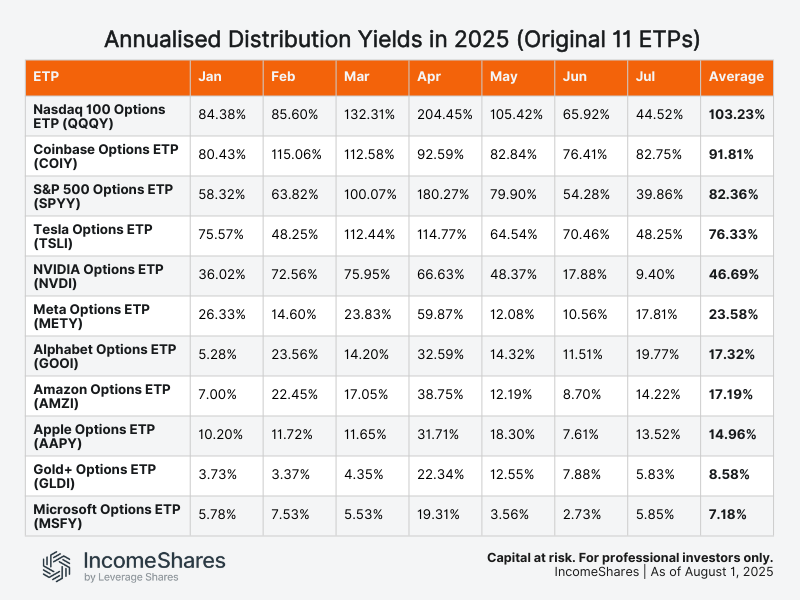

Out of those 19 ETPs, eleven have been trading throughout 2025. The table below shows the annualised distribution yields reported each month of this year (January through July) for those original eleven ETPs:

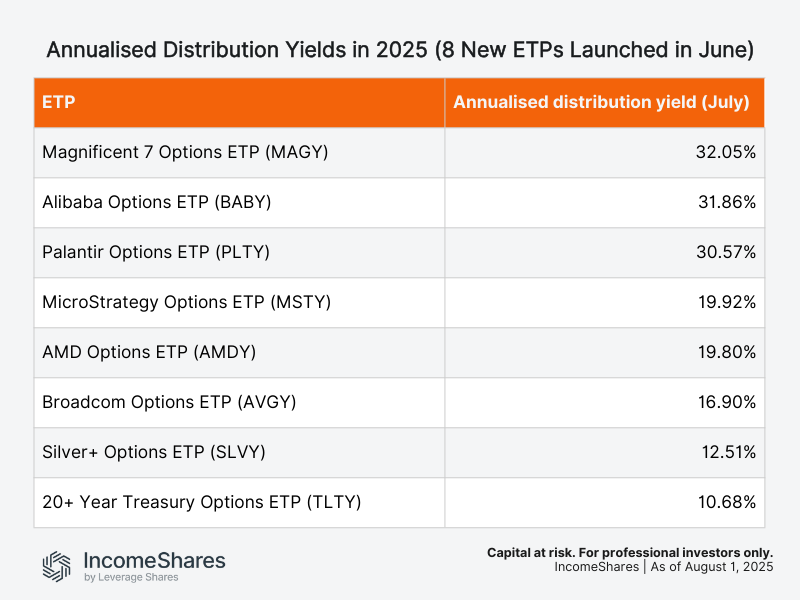

The remaining eight ETPs launched in late June – so they only have one full month of distributions so far (July):

Su capital está en riesgo si invierte. Podría perder toda su inversión. Por favor, consulte la advertencia de riesgos completa aquí.

Productos Relacionados:

Estrategia

Put garantizado con efectivo + Acciones de QQQ

Rendimiento de

Distribución

50.88%

Estrategia

Put garantizado con efectivo + Acciones de SPY

Rendimiento de

Distribución

38.25%

Estrategia

Covered Call

Rendimiento de

Distribución

12.96%

Estrategia

Basket of Income-generating ETPs

Rendimiento de

Distribución

49.20%

Estrategia

Covered Call

Rendimiento de

Distribución

17.54%