.webp)

Autor

Jonathan Hobbs, CFA

Fecha

20 Oct 2025

Categoría

Education

How Reinvesting Yields in Options ETPs Can Compound Income

Su capital está en riesgo si invierte. Podría perder toda su inversión. Por favor, consulte la advertencia de riesgos completa aquí.

Albert Einstein supposedly called compound interest the eighth wonder of the world. But how might it work with compounding income from options ETPs? These products sell options to generate income – and then aim to pay out that income as dividends to investors. When investors reinvest their ETP dividends instead of taking them as cash, it can create a compound income effect.

This article explores the potential benefits of compounding ETP yield, along with the associated risks and considerations.

How compound income works in options ETPs

Compounding income essentially means “earning income on your income”. In an options-based ETP, that income comes from “premiums” earned from selling call or put options.

If you choose to reinvest income distribution yields back into the ETP, you can pick up more units of the ETP. Each new unit may then earn its own income, which could help grow your overall income pot over time.

Hypothetical example

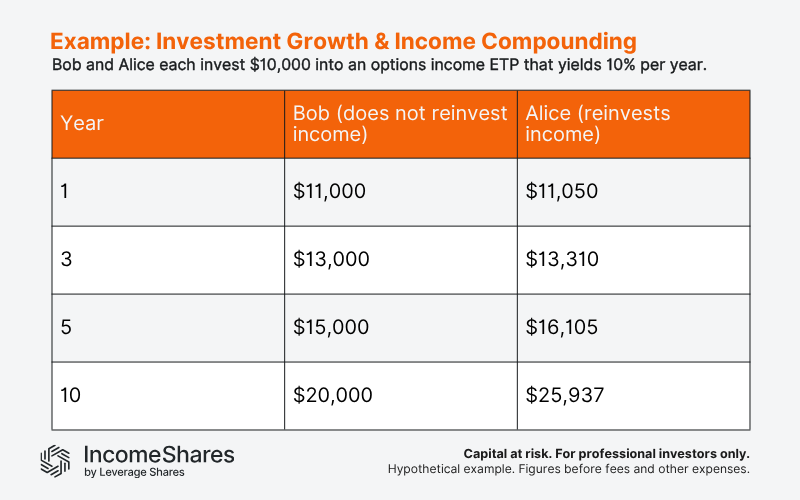

Let’s say Bob and Alice each invest $10,000 in an options-income ETP that yields 10% per year. To keep the numbers simple, assume the net asset value of the ETP never changes.

Bob takes his income as cash. He earns around $1,000 a year in distributions.

Alice keeps reinvesting her monthly income back into the same ETP.

The table below shows the value of each investment over time:

At first, the difference is small – just $50 after year one. But as Alice keeps reinvesting, the compound-income effect accelerates. Each reinvested payout earns its own income, and over time, that effect gets larger. By year ten, Alice has roughly $25,900, versus Bob’s $20,000 – nearly a $6,000 difference.

Associated risks and considerations

Reinvesting income can be a powerful wealth-building strategy in the long run, but it’s not guaranteed to boost total returns in every scenario. Here are some things investors should keep in mind:

NAV changes: The net asset value of an options ETP can rise or fall over time. If income payouts exceed growth in the underlying assets, the ETP could see NAV erosion. And if the underlying assets rebound, that recovery can add to total returns. Reinvesting income during low NAV periods can boost future returns if the NAV climbs again. But it could also increase risk if the NAV keeps falling.

Trading and FX costs: Reinvesting income every month creates extra trading. Each trade can include small dealing and currency-conversion costs. Those costs can reduce how much income actually compounds over time.

Tax: Some investors pay tax on distributions – even when they reinvest them straight away. Tax rules differ by country, so investors should check their own situation before deciding how to reinvest.

Variable yields: Options income changes with volatility and market prices. When yields fall, the compounding effect slows. When they rise, it speeds up. Over time, reinvestment can smooth those ups and downs as income levels change.

Automation: Some brokers offer dividend-reinvestment plans (DRIPs). These plans automatically use each payout to buy more ETP units, helping investors compound income without manual trading.

For long-term investors, income reinvesting can help keep capital working every month. Just like reinvesting rent from a property, reinvesting ETP income means your capital base can potentially grow with each payout.

Key takeaways

Reinvesting options ETP income can create a compound income effect – earning income on previously earned income.

Small differences early on can widen meaningfully over time if yields persist.

Trading costs, taxes, and NAV movements all affect real-world outcomes.

A dividend-reinvestment plan can automate the compounding process.

Su capital está en riesgo si invierte. Podría perder toda su inversión. Por favor, consulte la advertencia de riesgos completa aquí.

Productos Relacionados:

Estrategia

Put garantizado con efectivo + Acciones de TSLA

Rendimiento de

Distribución

53.55%

Estrategia

Put garantizado con efectivo + Acciones de Coinbase

Rendimiento de

Distribución

85.82%

Estrategia

Covered Call

Rendimiento de

Distribución

12.06%

Estrategia

Basket of Income-generating ETPs

Rendimiento de

Distribución

43.64%

Estrategia

Covered Call

Rendimiento de

Distribución

12.32%

Estrategia

Covered Call

Rendimiento de

Distribución

12.13%