.webp)

Author

Jonathan Hobbs, CFA

Date

12 Aug 2025

Category

Market Insights

IncomeShares 2025 ETP Growth Snapshot

Your capital is at risk if you invest. You could lose all your investment. Please see the full risk warning here.

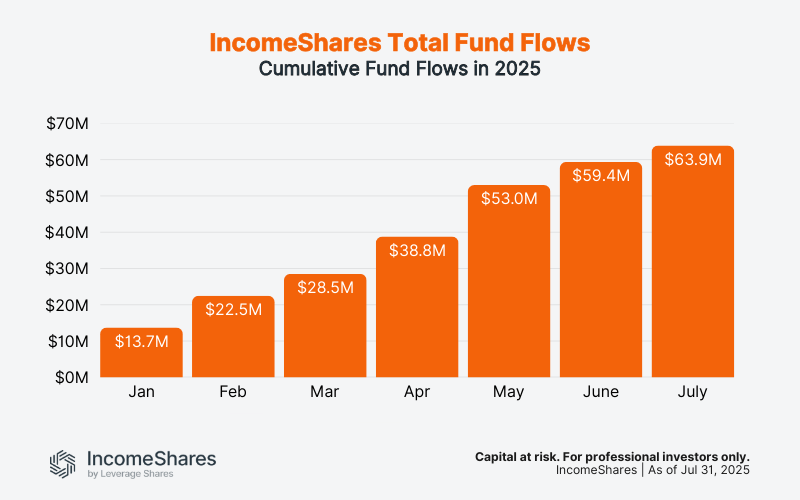

1. Cumulative fund flows

Cumulative fund flows represent the total amount of capital that has entered (or exited) the IncomeShares ETP range over time. Positive cumulative flows mean more money has come in than gone out – a sign of growing investor demand for IncomeShares products.

As shown in the chart below, IncomeShares ETPs have seen consistent monthly inflows throughout 2025. Cumulative fund flows climbed from $13.7 million in January to reach $63.9 million by the end of July. Each month has built on the last, reflecting growing interest in options-based strategies that aim to generate income.

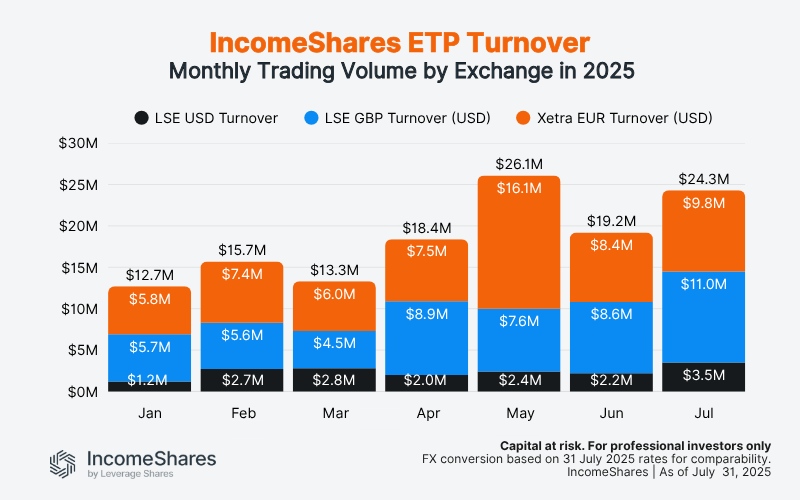

2. Trading turnover growth

Trading turnover refers to the total dollar value of IncomeShares ETPs bought and sold by investors. A higher turnover means more trading activity.

Combined turnover across IncomeShares ETPs for July was $24.3 million. The chart below shows the monthly breakdowns by exchange and currency listing, using end-of-July GBPUSD and EURUSD exchange rates for comparability.

Total turnover has almost doubled since January. The data suggests increasing demand for options-based income strategies across listed venues in Europe and the UK.

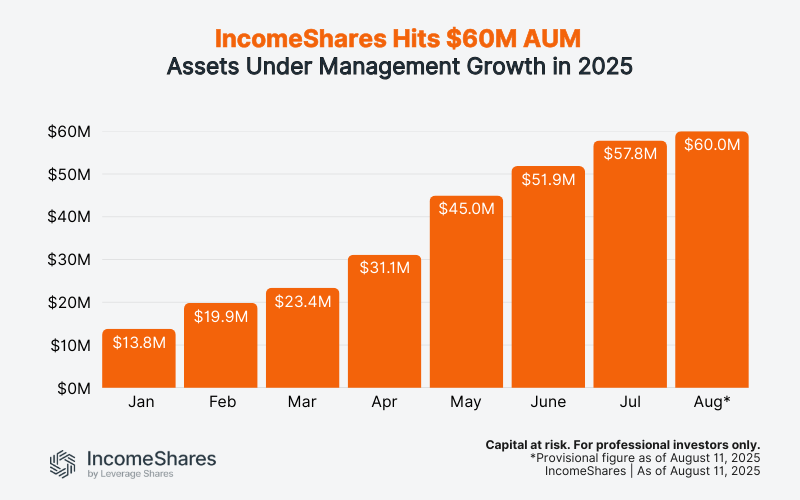

3. Assets under management (AUM) growth

IncomeShares hit a new milestone in August: $60 million in total AUM.

AUM has grown every month this year, from $13.8 million in January to $60 million as of 11 August – even as our ETPs continue to pay out consistent monthly income to investors.

IncomeShares currently offers 19 ETPs that aim to generate monthly income by selling options on single stocks, US stock market indexes, Treasury bonds, and commodities. The ETPs also have some upside exposure to the underlying investments themselves, based on their strategy and market conditions.

Your capital is at risk if you invest. You could lose all your investment. Please see the full risk warning here.

Related Products:

Strategie

Barbesicherte Puts + Eigenkapital

Ausschüttungsrendite

45.85%

Strategie

Barbesicherte Puts + Eigenkapital

Ausschüttungsrendite

40.89%

Strategie

Covered Call

Ausschüttungsrendite

5.69%

Strategie

Basket of Income-generating ETPs

Ausschüttungsrendite

31.74%

Strategie

Covered Call

Ausschüttungsrendite

10.61%

Strategie

Covered Call

Ausschüttungsrendite

12.06%