.webp)

Auteur

Jonathan Hobbs, CFA

Date

14 Nov 2025

Catégorie

Education

US Withholding Tax: Why Irish Funds Help EU/UK Investors

Votre capital est exposé à un risque si vous investissez. Vous pouvez perdre la totalité de votre investissement. Veuillez consulter l’avertissement complet sur les risques ici

When a US fund pays income to investors outside the US, the US government may take a cut first. That’s called withholding tax. The default rate is 30%, or around 15% if a tax treaty applies and the right paperwork is in place. This tax can slow compounding potential, reduce income distributions, and weaken the long-term return of any income strategy.

This article explains how US withholding tax works at the fund level for EU and UK investors. We’ll also explain why Irish-domiciled options funds may offer a more tax-efficient structure for income-seeking investors.

How US withholding tax works at the fund level

The US withholding tax rate for income from funds depends on where the fund legally “lives”. A US-domiciled fund sends its income out of the US, so the Internal Revenue Service (IRS) treats the entire distribution as US-source income. That rule applies whether the fund earns the income from selling options or stock dividends. The source of the cash doesn’t matter to the IRS – but the US fund location does.

A US fund pays 30% withholding tax by default when it sends income overseas. Some investors can reduce that rate to around 15% with the right treaty paperwork, but the cut still applies. So if a US income fund distributes $100 of income, only $70–$85 reaches a European or UK investor before any local taxes. And if the investor reinvests that income, the compounding potential can start from a lower base.

Funds that wrap US products inside a European listing face the same issue because they still pay income from inside the US. The US government withholds before investors see the income payout. The wrapper doesn’t change the tax treatment.

How US withholding tax works for Irish-domiciled funds

Ireland has a strong tax treaty with the US. Ireland-domiciled funds typically pay 15% withholding tax on US dividends they receive. But when an Irish fund sells options on US-listed assets, the IRS treats that income as trading profits, not dividends. So, it doesn’t apply withholding tax to that income at the fund level.

That means more income may stay in the fund before fees. More of it may be available for distribution. And more of it could potentially compound over time.

Example: US vs Irish income funds

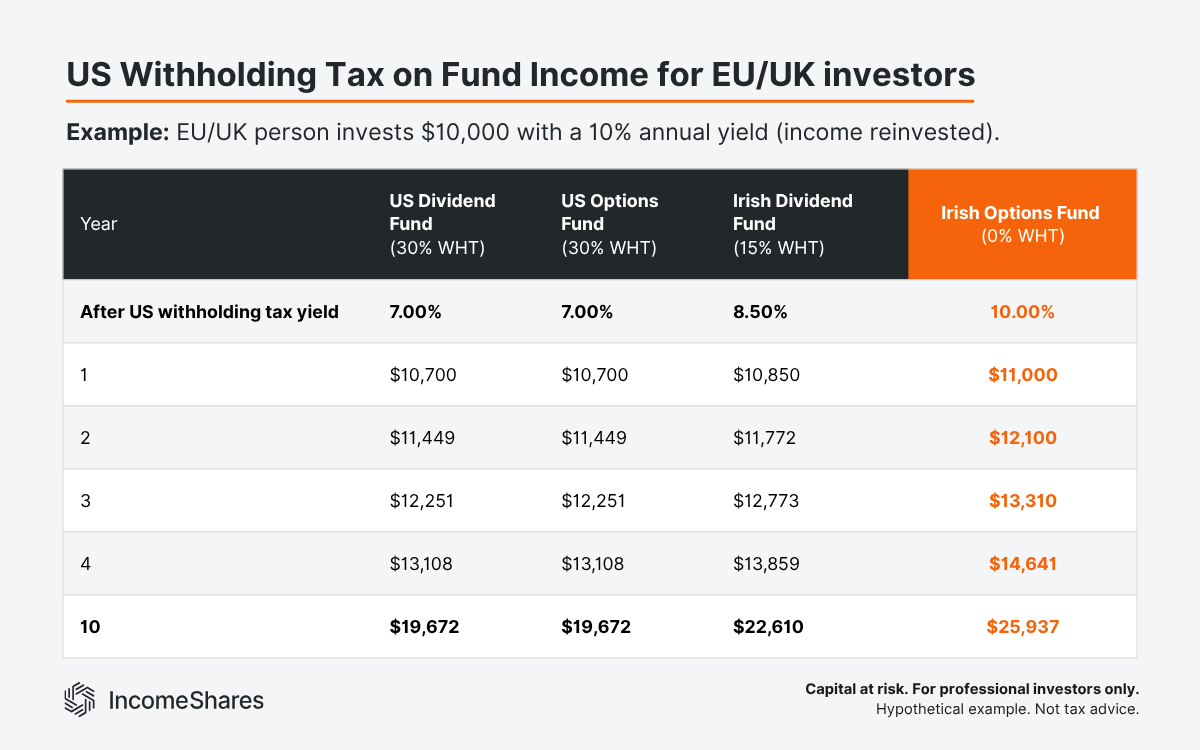

The table below shows how US withholding tax may affect an EU/UK income investor over time. Each example starts with $10,000, earns a 10% annual yield, and reinvests that income back into the fund every year. The differences come from the type of income each fund earns and how the IRS applies US withholding tax at each fund level.

Note: The table ignores local taxes in the EU and UK, and is just for illustrative purposes. These are hypothetical positive scenarios, and actual investment outcomes can include losses.

US-domiciled dividend fund: earns income from US stock dividends. The IRS withholds 30% of these dividends from EU/UK investors, so the 10% yearly dividend yield drops to 7%. If the investor reinvests that 7% back into the fund over ten years, the $10,000 compounds to $19,672.

US-domiciled options fund: earns income from selling options, but the fund still pays distributions out of the US. The IRS treats those distributions as “US-source income”, so the fund still loses 30% to withholding tax. Again, the 10% yield becomes 7%. After ten years of income reinvestment, the value also reaches $19,672.

Irish-domiciled dividend fund: also earns dividends from US stocks. It uses the US–Ireland tax treaty, which sets withholding tax at 15%. A 10% dividend yield becomes 8.5% after withholding tax. If the investor reinvests that over ten years, the $10,000 compounds to $22,610.

Irish-domiciled options fund: earns income from selling options on US-listed assets, not dividends. Since the Irish fund sells US options directly, the IRS treats that income as trading profits, so there’s no withholding tax. A 10% options yield stays at 10%, compounding $10,000 into $25,937 after ten years of income reinvesting.

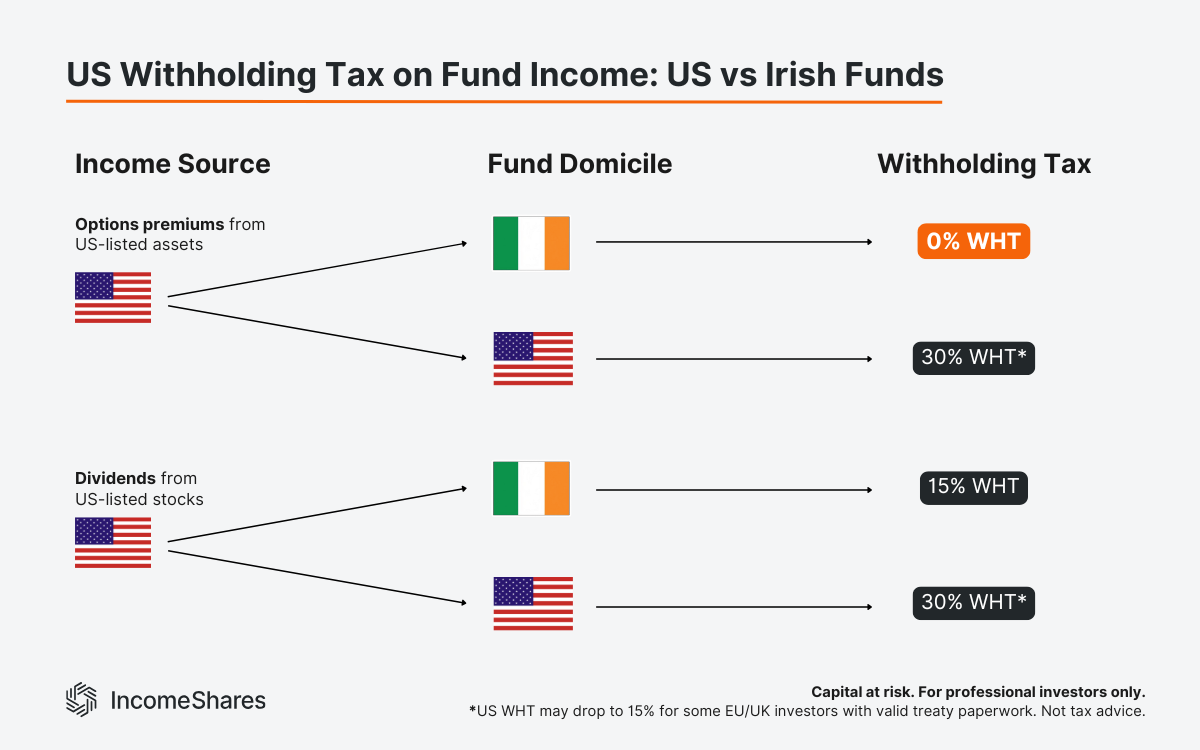

Summary graphic: US vs Irish income funds and withholding tax

The infographic below maps out how US withholding tax applies to both US- and Irish-domiciled funds, depending on the original income source.

IncomeShares exchange-traded products are Irish-domiciled. Options income distributions to non-US investors are not subject to U.S. withholding tax at the fund level, unlike some US-based ETFs, which can deduct up to 30%. IncomeShares ETPs may also receive stock dividends from underlying stock holdings, which may be subject to US withholding tax.

Key takeaways

US-domiciled income funds lose 30% (or 15% with treaties) to US withholding tax before distributions reach UK or EU investors.

Irish-domiciled funds pay 15% withholding on US dividends, but they pay 0% on option premium earned through direct trading.

More income staying inside the fund may lead to stronger compounding and higher long-term reinvestment potential.

Votre capital est exposé à un risque si vous investissez. Vous pouvez perdre la totalité de votre investissement. Veuillez consulter l’avertissement complet sur les risques ici

Produits associé:

Stratégie

Option de vente couverte par liquidités + actions

Rendement des

distributions

51.64%

Stratégie

Covered call

Rendement des

distributions

13.21%

Stratégie

Basket of Income-generating ETPs

Rendement des

distributions

49.36%

Stratégie

Covered Call

Rendement des

distributions

11.90%

Stratégie

Covered Call

Rendement des

distributions

18.40%