.webp)

Auteur

Jonathan Hobbs, CFA

Date

02 May 2025

Catégorie

Market Insights

What Investors Get Wrong About NAV Erosion in Options Income ETPs

Votre capital est exposé à un risque si vous investissez. Vous pouvez perdre la totalité de votre investissement. Veuillez consulter l’avertissement complet sur les risques ici

NAV erosion often sounds like a warning sign. But in options-based income ETPs (exchange-traded products), a drop in NAV after a distribution may not be such a bad thing. In fact, it's exactly what you’d expect. This article breaks down what NAV erosion really means – and why it may not signal a loss for investors.

What is the NAV?

NAV stands for Net Asset Value – the total value of an ETP’s assets, minus any operating costs.

That includes:

- The value of the stocks (or other assets) it holds.

- Plus any cash on hand (like option premiums).

- Minus any trading fees or administrative costs.

The NAV is typically calculated daily. But for income-focused options ETPs, NAV alone doesn’t tell the full story.

How options income affects the NAV

Options income ETPs aim to generate regular cash flows. They do this by selling call or put options on underlying assets like single stocks, gold, or stock market indices.

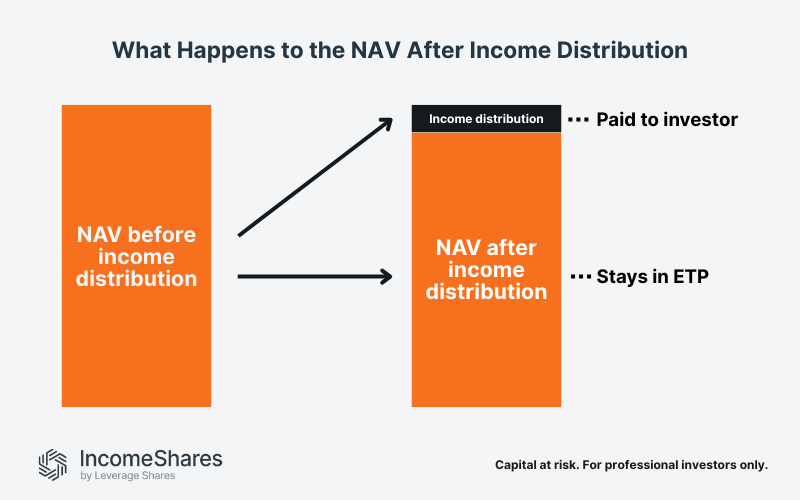

The income received from selling these options (known as premiums) becomes part of the ETP’s NAV. And when those premiums are distributed to investors, the NAV goes down.

What happens to the NAV when the ETP pays income?

When the ETP pays out income, the NAV drops by the same amount – this is called NAV erosion. NAV erosion is not a loss – it’s a transfer of value from the ETP to the investor’s account.

Example:

- NAV before distribution: $100

- Distribution paid out: $1

- NAV after distribution: $99

- Total investor value: $99 (NAV) + $1 (cash) = still $100

So while the NAV decreases, the investor’s overall value stays the same.

Why a lower NAV isn’t always a red flag

One of the most common misconceptions is that a falling NAV means the ETP is underperforming. But for high-yield options strategies, that drop is often expected.

That said, a lower NAV may limit future income potential. If the ETP holds fewer assets, it may generate less options income going forward — unless replenished through asset gains or premiums.

Focus on total return

NAV alone doesn’t measure how much an investor has actually gained or lost. That’s where total return comes in.

Total return = NAV movement + income distributions paid

An ETP might have a falling NAV but still deliver strong overall returns through consistent monthly income. That’s why it’s important to view both elements together.

Key takeaways

- NAV erosion is normal in income-focused options ETPs

- It represents a value transfer, not a loss

- Lower NAV can reduce future income potential, but isn’t a problem on its own

- Investors should focus on total return, not just NAV movement

Votre capital est exposé à un risque si vous investissez. Vous pouvez perdre la totalité de votre investissement. Veuillez consulter l’avertissement complet sur les risques ici

Produits associé:

Stratégie

Option de vente couverte par liquidités (cash) + actions

Rendement des

distributions

57.06%

Stratégie

Option de vente couverte par liquidités (cash) + actions

Rendement des

distributions

42.39%

Stratégie

Option de vente couverte par liquidités + actions

Rendement des

distributions

132.21%

Stratégie

Option de vente couverte par liquidités + actions

Rendement des

distributions

50.62%

Stratégie

Option de vente couverte par liquidités + actions

Rendement des

distributions

38.11%