.webp)

Auteur

Jonathan Hobbs, CFA

Date

16 Feb 2026

Catégorie

Education

How To Build an Options Income ETP Portfolio

Votre capital est exposé à un risque si vous investissez. Vous pouvez perdre la totalité de votre investissement. Veuillez consulter l’avertissement complet sur les risques ici

Income options ETPs can look similar on the surface. They sell options for income potential while holding some degree of exposure to their underlying assets. But their strategies, underlying asset classes, and risk profiles might differ under the hood. That’s why diversification may be worth exploring.

In this article, we explain how to build an income ETP portfolio using three illustrative examples. These are not recommendations.

Not all options income ETPs are the same

Income ETPs can target different underlying exposures – like stocks, indices, commodities, or bonds. Their strategies can differ, too. Some might sell put options to generate income, while others sell call options.

That means income distribution yields, total returns, and volatility can cover a wide range across different ETPs. Higher yields don’t always mean higher total returns, and lower volatility doesn’t always mean lower income.

Three IncomeShares ETPs and how they differ

Let’s use three IncomeShares ETPs to explain the potential effects of diversification across different asset classes and income strategies.

Magnificent 7 Options ETP (MAGO): uses a cash-secured put plus equity strategy. The ETP invests in an equal-weighted basket of individual IncomeShares Magnificent 7 ETPs, rebalanced semi-annually. Each underlying ETP aims to maintain around 25% direct equity exposure to its respective stock. It uses the remaining 75% to sell put options for potential income from option premiums.

IncomeShares Gold+ Yield ETP (GLDI): uses a covered call strategy. The ETP holds exposure to SPDR® Gold Shares (GLD) and sells call options on GLD for potential income from option premiums.

IncomeShares 20+ Year Treasury Options ETP (TLTY): uses a similar covered call strategy to GLDI, but with the iShares 20+ Year Treasury Bond ETF (TLT).

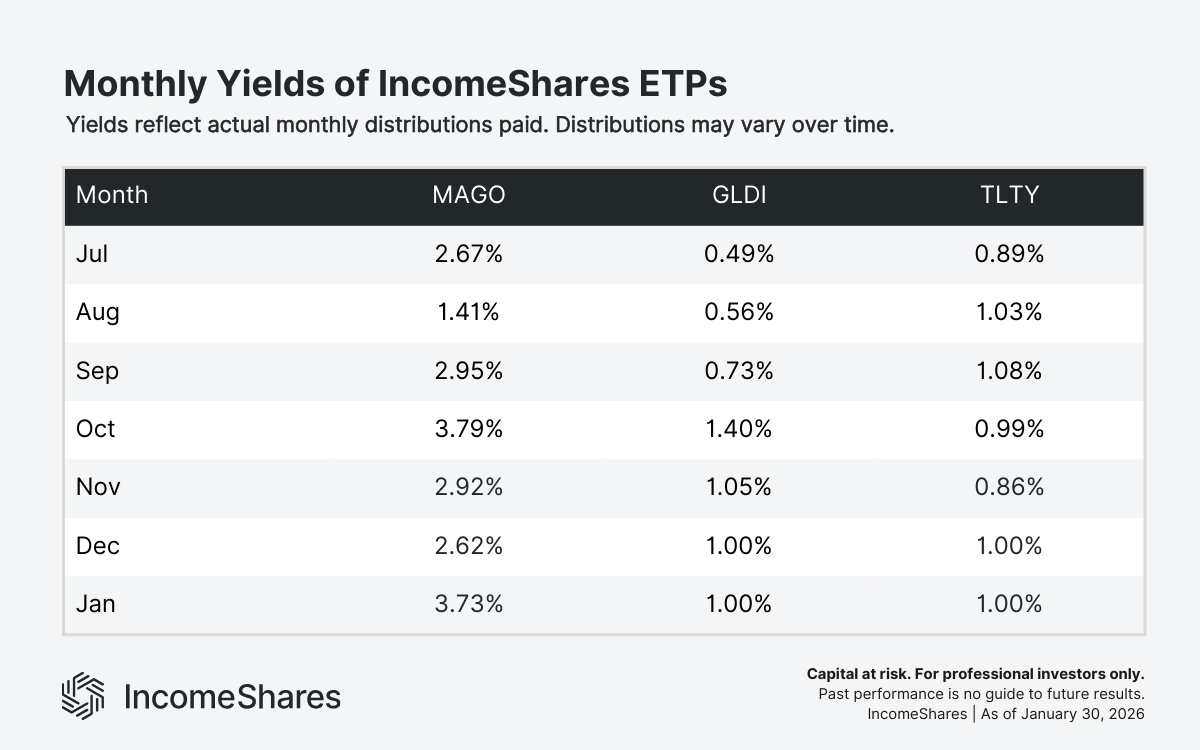

Two of these ETPs – MAGO and TLTY – launched on 27 June 2025. The table below shows how the dividend yields for all three ETPs differed from July through January:

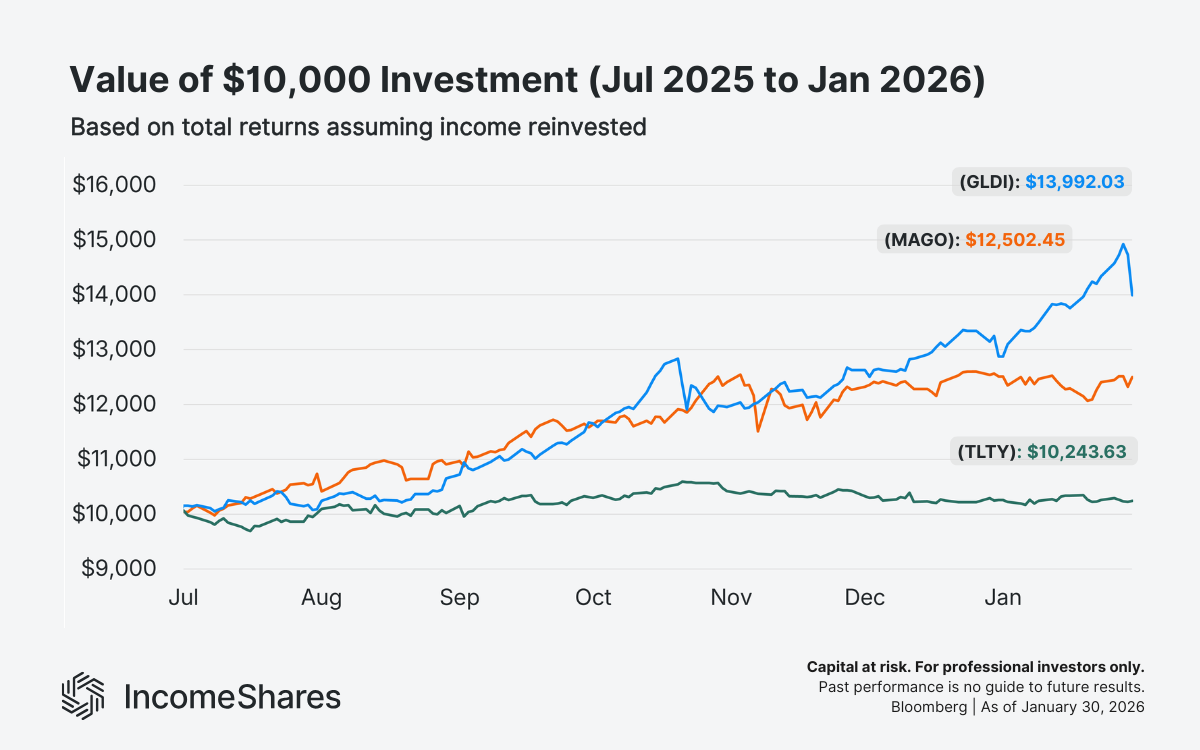

The next chart shows how a $10,000 investment in each ETP would have performed over the period. We’ve used total returns here to account for the changes in each ETP’s net asset value per share with income reinvested.

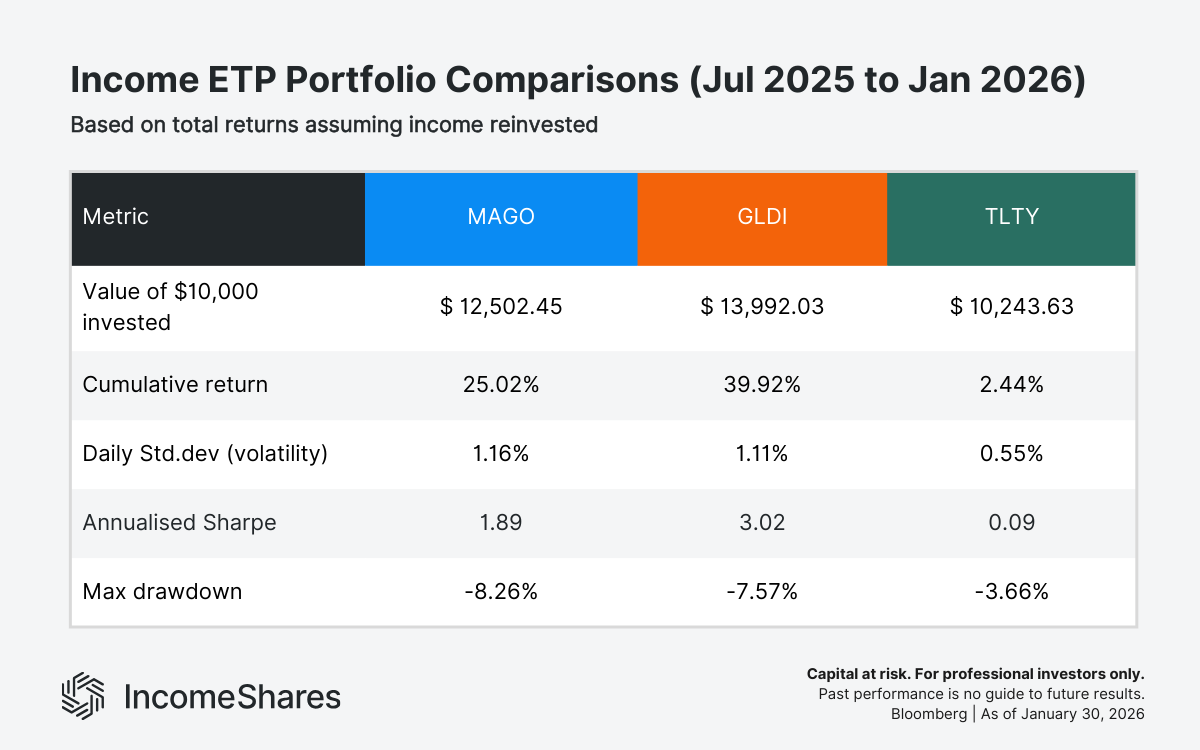

And finally, we can compare the volatility, drawdowns, and Sharpe ratios of each ETP over the period:

Hypothetical example: Three options income ETP portfolios

We can now use the same ETPs to backtest three different income ETP portfolios over that same period:

Portfolio 1: Just MAGO

Portfolio 2: Half in MAGO and half in GLDI

Portfolio 3: Split equally between MAGO, GLDI, and TLTY

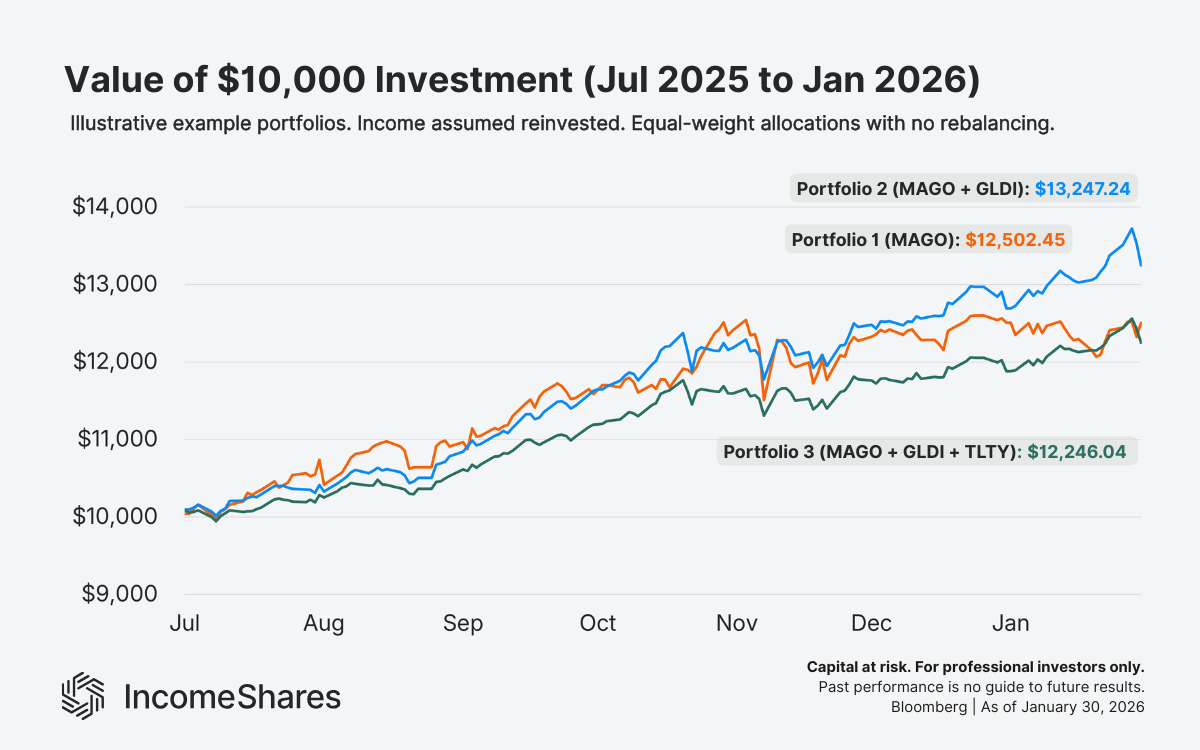

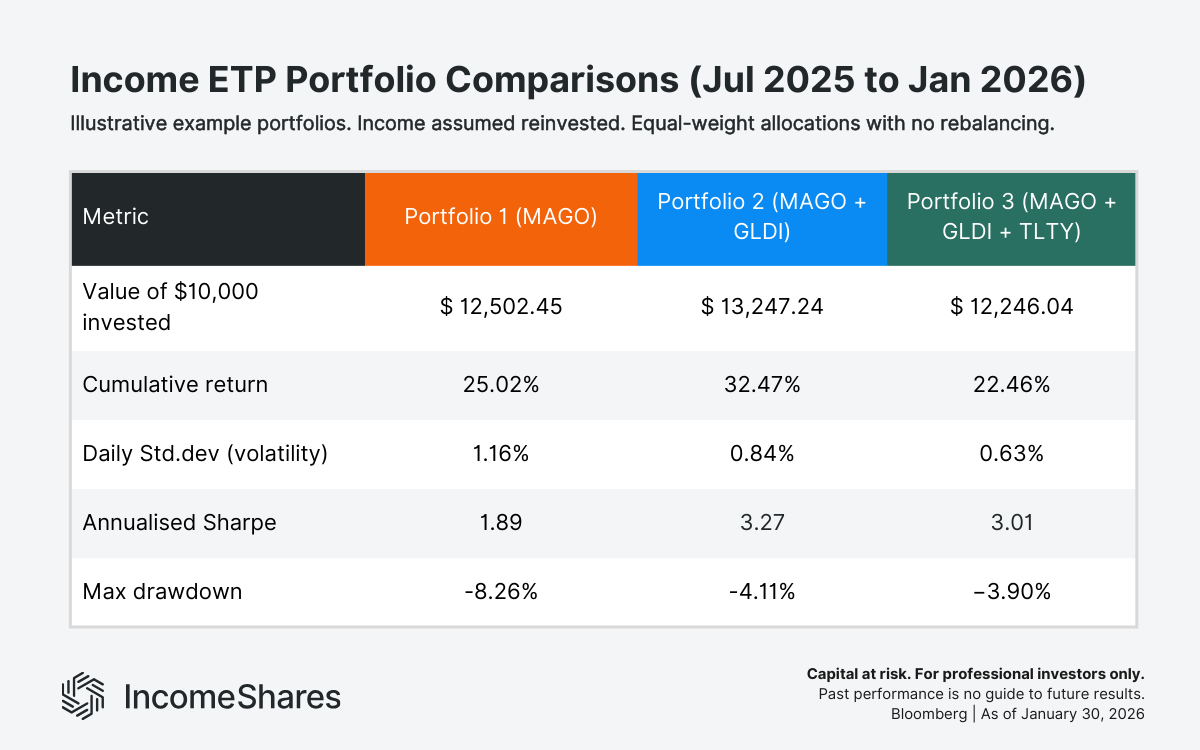

The charts below show how the performance would have been different for each portfolio.

The examples above show how income diversification can change both return and risk over time.

What investors might consider when building income ETP portfolios

1. Income diversification starts with risk tolereance. Different income ETPs can behave very differently in volatile markets. Some strategies experience larger drawdowns than others. Investors should decide what level of short-term volatility they’re comfortable with before focusing on yield.

2. Income versus total return. A higher distribution doesn’t always mean a higher total return. Over time, both elements are important for income portfolios. Looking at income in isolation can give an incomplete picture.

3. Asset mix also plays a role in income portfolio diversification. Stock-linked strategies, commodity, and fixed income products can respond differently to market conditions. Combining different asset classes may help smooth returns, but it can also reduce upside during strong rallies. The mix should reflect the investor’s objectives.

4. Portfolio weights aren’t neutral. An equal-weight portfolio can be simple and transparent, but it may not be optimal for the investor. Increasing exposure to higher-yielding products can raise income, but it may also increase volatility. Weighting decisions directly affect risk and return.

5. Rebalancing can make a difference over time. If you start with a 50-50 split, for example, that balance will change as markets move. That’s because one holding may grow faster than the other. Over time, your portfolio can look very different from your original split.

Rebalancing simply means adjusting the portfolio back to your chosen weights. That could involve trimming a position that has grown and adding to one that has lagged. Some investors do this on a set schedule, while others only adjust when allocations move beyond a certain level.

Key takeaways

Income ETPs can have different risks and returns, depending on their strategy and underlying exposures.

Combining ETPs into a diversified portfolio may help smooth overall returns.

Investors should consider their own risk tolerance and goals when building income ETP portfolios.

Votre capital est exposé à un risque si vous investissez. Vous pouvez perdre la totalité de votre investissement. Veuillez consulter l’avertissement complet sur les risques ici

Produits associé:

Stratégie

Covered call

Rendement des

distributions

12.96%

Stratégie

Basket of Income-generating ETPs

Rendement des

distributions

49.20%

Stratégie

Covered Call

Rendement des

distributions

11.83%