.webp)

Author

Jonathan Hobbs, CFA

Date

13 Mar 2025

Category

Market Insights

What a VIX Rise Means for Options Income Strategies

Your capital is at risk if you invest. You could lose all your investment. Please see the full risk warning here.

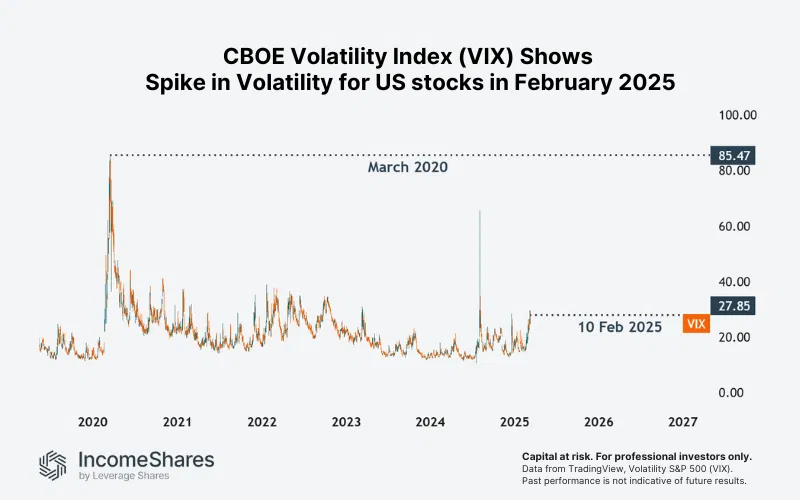

After months of steady gains, the S&P 500 is now in a downtrend. Meanwhile, the VIX – aka the market’s “fear gauge” – has surged higher. Market sentiment has shifted, with geopolitical concerns and uncertainty around Federal Reserve policy fueling the sell-off. As a result, volatility is back – and that can impact different options-based income strategies in important ways.

What is the VIX, and why has it risen

The VIX (CBOE Volatility Index) measures how much investors expect the US stock market to fluctuate over the next 30 days, based on S&P 500 option prices. It’s calculated by combining the weighted price of the index’s put and call options for the next 30 days.

When investors become more uncertain, they typically buy more options – especially put options as hedges. This may drive up option premiums, pushing the VIX higher.

On 10 March 2025, the VIX closed at 27.85, its highest level since mid-2024, according to data from TradingView. While this is nowhere near the extreme 85.47 reading seen in March 2020, it does signal rising investor anxiety. Higher volatility can impact trading strategies, particularly those that involve selling options to generate income.

The S&P 500 index has fallen

The S&P 500 is the benchmark index for the 500 largest US companies. It had been climbing steadily since late 2023 but peaked in mid-February before pulling back sharply.

At one point on 11 March, the SPDR® S&P 500 ETF (SPY) was down almost 10% from its mid-February high. Not quite the minus 20% “bear market” threshold, but still a steep drop.

This shift in the market may present both risks and opportunities for investors using options-based income strategies.

How volatility impacts options-based income strategies

When volatility increases, options premiums tend to rise. That’s because options prices are partly based on expected future market price movement. In uncertain conditions, traders are typically willing to pay more for downside protection.

This affects different income-focused options strategies in different ways:

Cash-secured puts:

Cash-secured put strategies – like those used in some IncomeShares ETPs – aim to generate income by selling put options on major indices (such as the S&P 500).

When volatility rises, those option premiums typically increase – which may mean higher income potential. But if the S&P 500 falls below the put option’s strike price, there’s a higher chance of assignment. That means the put seller may end up having to buy the underlying asset at the strike price, even if its value has dropped.

Covered calls:

Covered call strategies tend to perform best when markets are trading sideways or slowly rising. These strategies aim to generate income by selling call options and holding the underlying stock or asset.

In a down market, covered calls may still generate some premium income. This may partially cushion losses – but doesn’t provide downside protection.

For income investors, understanding how market volatility impacts options strategies is crucial.

Key Takeaways

- The VIX has spiked, signaling rising market uncertainty and investor anxiety.

- Meanwhile, the S&P 500 has pulled back from its mid-February high.

- Cash-secured put strategies may benefit from higher option premiums in volatile markets, but assignment risk increases.

- Covered calls may still generate income in volatile markets, though large price swings may make them more challenging.

Your capital is at risk if you invest. You could lose all your investment. Please see the full risk warning here.

Related Products:

Strategie

Barbesicherte Puts + Eigenkapital

Ausschüttungsrendite

50.16%

Strategie

Barbesicherte Puts + Eigenkapital

Ausschüttungsrendite

32.93%

Strategie

Barbesicherte Puts + Eigenkapital

Ausschüttungsrendite

26.67%

Strategie

Barbesicherte Puts + Eigenkapital

Ausschüttungsrendite

28.13%

Strategie

Barbesicherte Puts + Eigenkapital

Ausschüttungsrendite

47.27%