Author

Jonathan Hobbs, CFA

Date

27 Nov 2024

Category

Martket Insights

Understanding Withholding Tax Exemptions for Options ETPs

Your capital is at risk if you invest. You could lose all your investment. Please see the full risk warning here.

Foreign investors like to invest in the US market. For income investors, that could mean paying a 30% US withholding tax on dividends and other income – which can eat away at their returns. But some options ETPs can reduce or even avoid this tax altogether, offering a more tax-efficient way to generate income. Here’s how it works.

What is withholding tax?

Withholding tax is a tax on dividends and other income paid to foreign investors. In the US, it typically amounts to 30% of the investment income for non-residents, though this rate could be reduced through tax treaties. When you invest in stocks or traditional dividend-paying ETFs, this tax is usually unavoidable. And it can cut into your income and total returns.

How options ETPs can help you avoid withholding tax

Options ETPs can use different strategies that may generate income for investors – such as selling call or put options to potentially earn premiums. Options income is typically classified as capital gains rather than regular income for tax purposes. So, there’s usually no US withholding tax for foreign investors. But if there’s dividend income from holding the underlying stocks in the ETP, that would still be taxed as usual.

And it makes sense: options trading can involve more risk than just owning a stock and watching the dividend roll in. The income from options trading usually comes from active management and skill – rather than passively collecting dividends. So, it makes sense to treat this income like the capital gains from trading a stock (which have no US withholding tax).

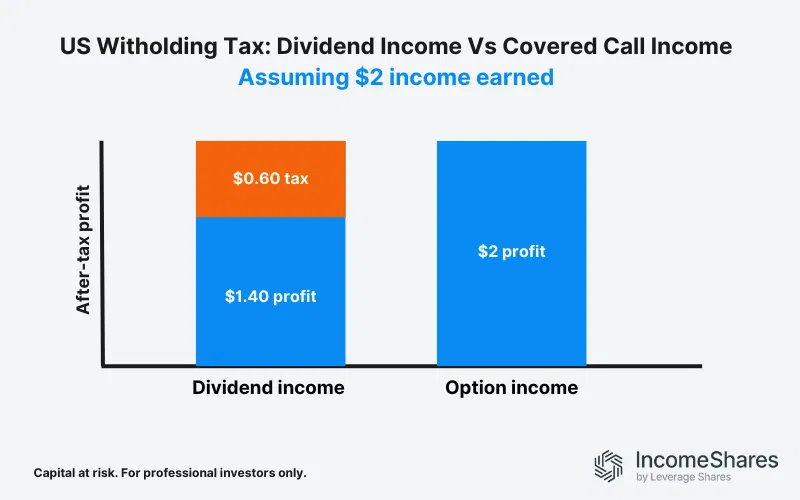

Example: Dividend vs covered call income ETP and the tax impacts

Let’s say you own shares of a US company that pays a $2 yearly dividend per share. As a foreign investor, you could be paying a 30% withholding tax on that dividend, reducing your profit to just $1.40 per share.

Compare that with a covered call ETP. This fund owns the same stock and sells call options on it to generate income. When the ETP collects premiums from selling those call options, that income is treated as a capital gain rather than a dividend. Since US withholding tax doesn’t apply to capital gains for foreign investors, you’d get to keep the full amount of the premium without any tax hit.

In other words, while dividends get taxed upfront, the income from covered calls stays intact. This can make a big difference for international investors looking to boost their after-tax returns.

How US withholding tax applies to IncomeShares products

IncomeShares offers ETPs that use options strategies. For example, we use options strategies on assets like the S&P 500 or gold. These products aim to generate income through options premiums, which may have different tax implications for non-US investors.

Key takeaways

Foreign investors might pay a US withholding tax of up to 30% on income generated from US investments. For example, on dividends from American stocks.

US tax authorities treat income earned from options like capital gains, rather than regular income. Therefore, there’s no withholding tax for options income.

By owning options ETPs, foreign investors won’t pay tax on the options income earned in the ETP. But if there’s dividend income from holding the underlying stocks in the ETP, that would still be taxed as usual.

Your capital is at risk if you invest. You could lose all your investment. Please see the full risk warning here.

Related Products:

Strategy

Cash-Secured Put + Equity

Distribution Yield

59.45%

Strategy

Cash-Secured Put + Equity

Distribution Yield

36.08%

Strategy

Cash-Secured Put + Equity

Distribution Yield

44.94%

Strategy

Cash-Secured Put + Equity

Distribution Yield

105.18%

Strategy

Covered Call

Distribution Yield

13.99%