Author

Jonathan Hobbs, CFA

Date

16 May 2025

Category

Martket Insights

Sell in May and Go Away? S&P 500 Return Comparison From 1950

Your capital is at risk if you invest. You could lose all your investment. Please see the full risk warning here.

The old investing adage says: "Sell in May and go away". It suggests investors should exit the stock market during the summer months and return in November. But when it comes to the S&P 500 index, long-term historical data suggests otherwise. Since 1950, staying invested through all months of the year generated a higher return than the Sell in May strategy.

What’s the logic behind the “Sell in May” saying?

Institutional investors often take time off during the summer months, and trading volumes may fall as a result. With lower participation, markets may experience thinner liquidity and more erratic price moves – especially in smaller or more volatile stocks. This may explain why some investors choose to reduce risk during this period. But historical data shows that exiting the market altogether has come at a cost.

Time in the market has outperformed

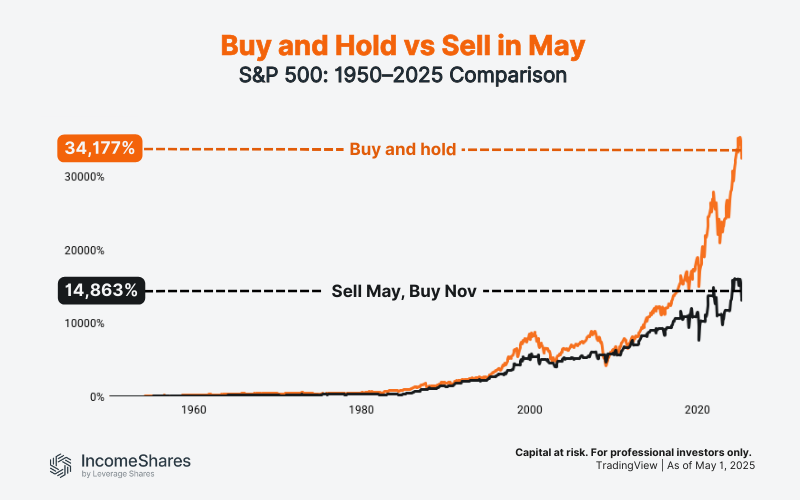

The chart below compares the growth of two strategies since the start of 1950 to May 2025:

Buy and hold strategy (orange line): Buying the S&P 500 index and holding through all months of the year.

Sell in May strategy (black line): Selling the S&P 500 at the start of May each year to hold cash. Then buying back into the index at the start of November. Note: these results assume no trading costs or tax implications.

From January 1950 to May 2025, the buy and hold strategy returned +34,177%. This equates to an 8.05% compound annual growth rate (CAGR) over the 75 years. The Sell in May strategy returned +14,863% over the same period – a 6.86% CAGR.

The yearly growth difference may seem small, but over 75 years it compounded into a significant gap. In this example, staying invested captured more of the market’s long-term growth.

TheIncomeShares S&P 500 Options (0DTE) ETP aims to generate monthly income by selling 0DTE put options on the S&P 500 Index or the SPY ETF.

Key takeaways

The Sell in May strategy involves exiting the stock market at the start of May and re-entering in November each year.

From 1950 to 2025, staying fully invested in the S&P 500 delivered higher returns than the Sell in May approach.

The annual performance gap was small, but compounding over 75 years made it significant.

Your capital is at risk if you invest. You could lose all your investment. Please see the full risk warning here.

Related Products:

Strategy

Cash-Secured Put + Equity

Distribution Yield

35.97%