Author

Jonathan Hobbs, CFA

Date

20 May 2025

Category

Market Insights

Gold vs Gold Miners: 10-Year Performance Comparison

Your capital is at risk if you invest. You could lose all your investment. Please see the full risk warning here.

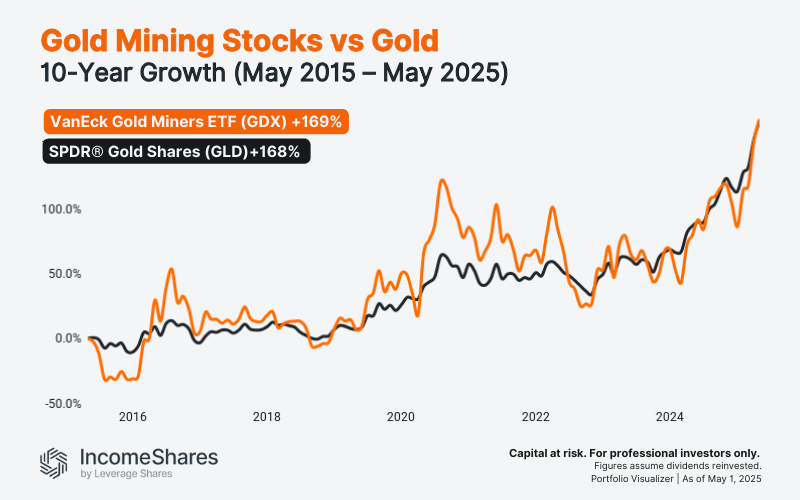

Gold and gold mining stocks delivered similar returns over the past decade. But one was far more volatile than the other.

GLD vs GDX 10-year performance

From May 2015 to May 2025, the VanEck Gold Miners ETF (GDX) returned 169%, with dividends reinvested. That works out to a 10.40% compound annual growth rate (CAGR). GDX tracks a portfolio of listed gold mining companies.

The SPDR® Gold Shares ETF (GLD) returned 168% in the same period – a 10.35% CAGR. GLD is designed to track the price of physical gold. Both exchange-traded funds delivered about the same growth, but GDX had larger price swings. The chart below compares the two, with GDX in orange and GLD in black.

But the risk profile wasn’t the same

Despite similar returns, the experience for investors was very different. Gold miners were significantly more volatile than gold itself.

Performance comparison based on $100 invested (May 2015 to May 2025):

Data source: Portfolio Visualizer. Based on monthly returns with dividends reinvested. May 2015 to May 2025.

Standard deviation measures how much returns fluctuate from year to year. GDX had over twice the volatility of GLD, meaning investors experienced bigger peaks and troughs.

Maximum drawdown refers to the largest peak-to-trough decline during the period. GDX’s worst drop was 43.3%, while GLD’s was less than half that.

Sharpe and Sortino ratios measure return relative to risk. Higher numbers typically indicate stronger risk-adjusted performance. GLD scored higher on both, reflecting lower volatility and smoother returns over the period.

The IncomeShares Gold+ Yield Options ETP (GLDI) aims to generate monthly income by selling call options on GLD, while having some exposure to the gold price.

Key takeaways

Gold and gold miners delivered almost identical total returns over the past decade.

GLD had far lower volatility, drawdowns, and risk metrics than GDX.

Options-based strategies like GLDI aim to provide monthly income from GLD exposure.

Your capital is at risk if you invest. You could lose all your investment. Please see the full risk warning here.

Related Products:

Strategy

Covered Call

Distribution Yield

12.49%