Author

Jonathan Hobbs, CFA

Date

30 Oct 2024

Category

Market Insights

How Call Options Work: Benefits, Risks, and Examples

Your capital is at risk if you invest. You could lose all your investment. Please see the full risk warning here.

Call options can be valuable tools for traders and investors. They can help you manage risk and potentially profit from volatile market swings. In this first part of our educational options investing guide, we explain what call options are, how they work, and their potential benefits and risks.

What are Call Options?

A call option is a financial contract between two parties: the option buyer and the seller.

Call option buyer: The buyer has the option (but not the obligation) to buy an asset at a preset price (strike price) on or before a specific date (expiration date). The buyer pays the seller an upfront fee (premium) for this right.

Call option seller: If the buyer exercises the option to buy the asset at the strike price, the seller is obligated to sell the asset to the buyer. In return, the seller receives the upfront premium as compensation.

Note: the underlying asset of a call option can be a stock, commodity, index, currency, or cryptocurrency. The basic point is that the call option gives the investor exposure to the underlying investment – whatever that investment may be.

Why Use Call Options?

If used wisely, call options can offer several advantages to traders and investors.

Hedging: Call options can help protect a portfolio from downside risk. Investors use them as a way to offset potential losses during volatile market conditions.

Speculation: Traders use call options to profit from potential price movements without owning the stock or underlying asset.

Income generation: Selling call options allows investors to collect premiums, generating income even if the stock’s price stays flat or moves slightly.

Buying a Call Option: How It Works

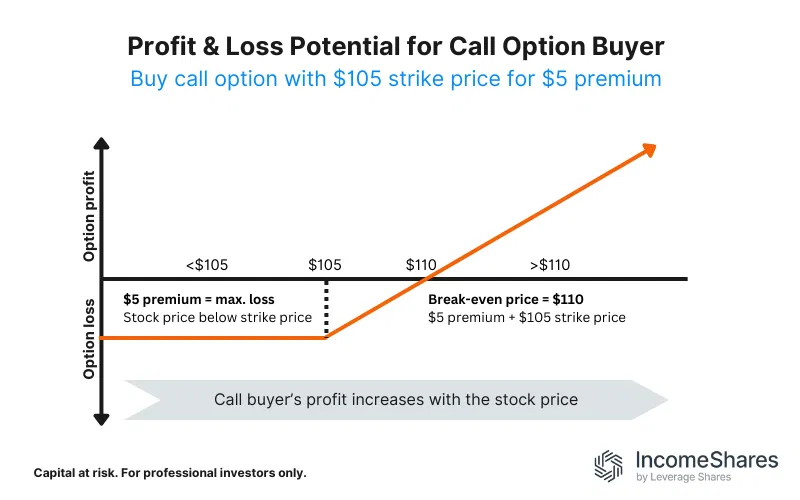

A stock is currently trading at $100 per share, and you believe its price will rise. So, you buy a call option with a strike price of $105, paying a $5 premium for the option. Here are some possible outcomes:

Loss scenario – The stock price stays below $105: If the stock price doesn’t rise above $105 before the option expires, the option becomes worthless, and your only loss is the $5 premium.

Break-even scenario – The stock price reaches $110: If the stock reaches $110, you can buy the stock for $105 and sell it for $110. The $5 profit per share covers the premium, so you break even.

Profit scenario – The stock price rises above $110: If the stock rises above $110, you start making a profit. For example, if the stock reaches $120, you can buy it for $105 and sell it for $120. After subtracting the $5 premium, your net profit is $10 per share.

Selling a Call Option: How It Works

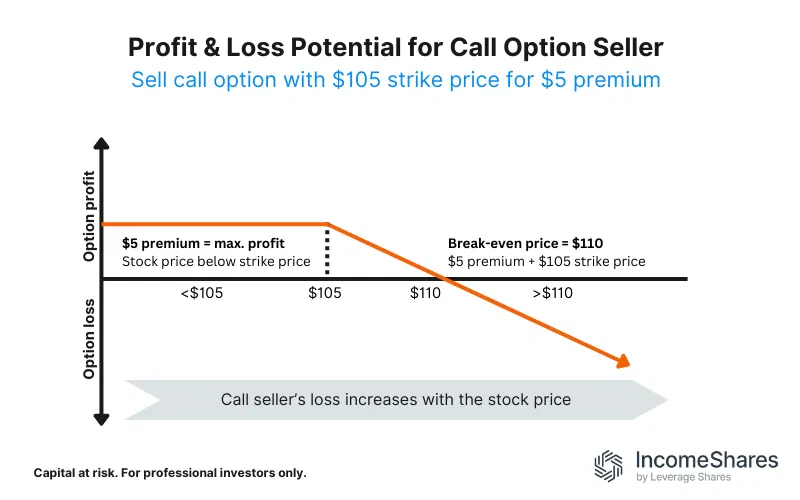

On the other side of the trade, there’s a call option seller who believes the stock won’t go above $105 by the contract’s expiration. The seller earns a $5 premium for selling you the call option. Here are a few potential outcomes:

Loss scenario – The stock price rises significantly above $105: You would exercise your option, and the seller must sell the stock to you for $105. For example, if the stock is trading at $120, the seller loses $15 per share. With the $5 premium received, the seller’s net loss is $10 per share. The seller’s risk is potentially unlimited since the stock price could, in theory, rise much higher before the expiration date.

Break-even scenario – The stock price reaches $110: In this case, you would also exercise the call option since the stock price is above the strike price of $105.The seller would sell you the stock for $105, losing $5 per share. But the $5 premium you paid the seller upfront offsets the loss, so the seller breaks even.

Profit scenario – The stock price stays below $105: If the stock price stays below $105, you won’t exercise the option. The seller keeps the $5 premium without further obligations, banking a $5 profit overall. This the maximum gain the call option seller can make.

Call Option Buyer vs. Seller: Risk and Reward

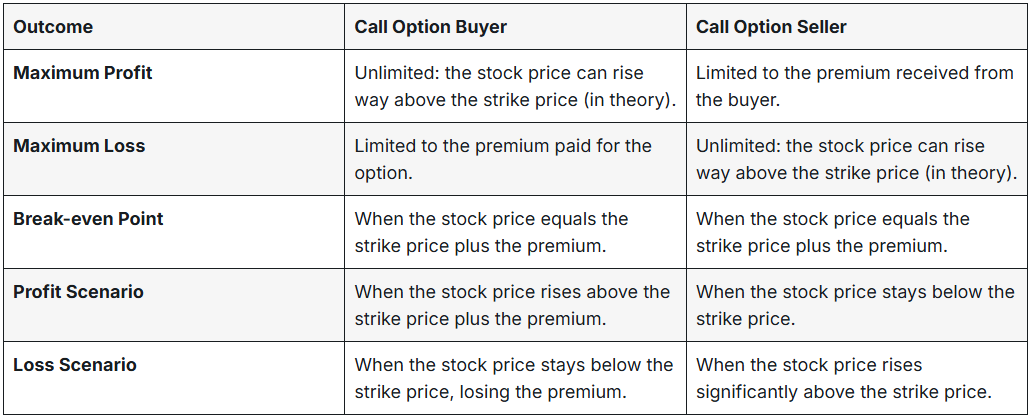

Now that we’ve covered both buying and selling scenarios, let’s summarize the key risks and rewards for each strategy.

So, to summarize:

Buying a call:

Limited risk: Your loss is capped at the premium paid.

Unlimited profit: Your potential gains increase as the stock price rises.

Ideal for upward price movements: This strategy works if you expect the stock price to rise.

Selling a call:

Limited profit: Your maximum profit is the premium received.

Unlimited risk: If the stock price rises, your losses can be significant.

Ideal for flat or downward markets: You benefit from premium income if the stock stays below the strike price.

Key Takeaways

Call options give buyers the right to buy an asset at a fixed price on or before a set date.

Buying a call option offers limited risk and potentially unlimited profit.

Selling a call option provides limited profit but exposes the seller to unlimited risk if the stock price keeps rising.

Your capital is at risk if you invest. You could lose all your investment. Please see the full risk warning here.

Related Products:

Strategy

Cash-Secured Put + Equity

Distribution Yield

51.89%

Strategy

Covered Call

Distribution Yield

12.06%