Author

Jonathan Hobbs, CFA

Date

30 Jun 2025

Category

Market Insights

Covered Call vs Cash-Secured Put Similarities

Your capital is at risk if you invest. You could lose all your investment. Please see the full risk warning here.

Covered calls and cash-secured puts are two options strategies designed to generate income. While they use different mechanics, they share the same basic idea: sell options, collect premiums, and manage risk on the underlying asset. Let’s unpack how they work – and why they’re more similar than they first appear.

What is a covered call?

A covered call is when you already own the stock (or other underlying asset) and sell a call option on it. If the price rises above the strike price by the end of the contract, you may be required to sell the stock. Until then, you keep any upside up to the strike. You also collect a premium up front – income from selling the call.

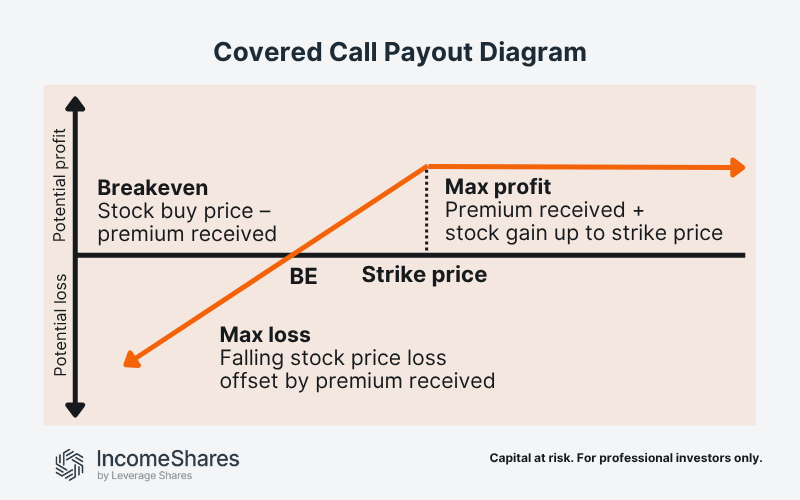

Here’s how the potential payout structure works for a covered call:

Maximum profit: the premium received, plus any stock gain up to the strike price.

Breakeven point: the stock purchase price minus the premium received.

Maximum loss: the stock could fall to zero, but the loss is offset slightly by the premium.

The covered call strategy tends to work best in sideways or modestly rising markets. That’s when investors may be content to hold the stock while generating potential income.

What is a cash-secured put?

A cash-secured put works the other way around. You set aside enough cash to buy a stock (or other asset) and sell a put option on it. If the price falls below the strike by the end of the contract, you may be required to buy the stock at that level. In return, you collect an option premium up front – and potentially buy the asset at a lower price.

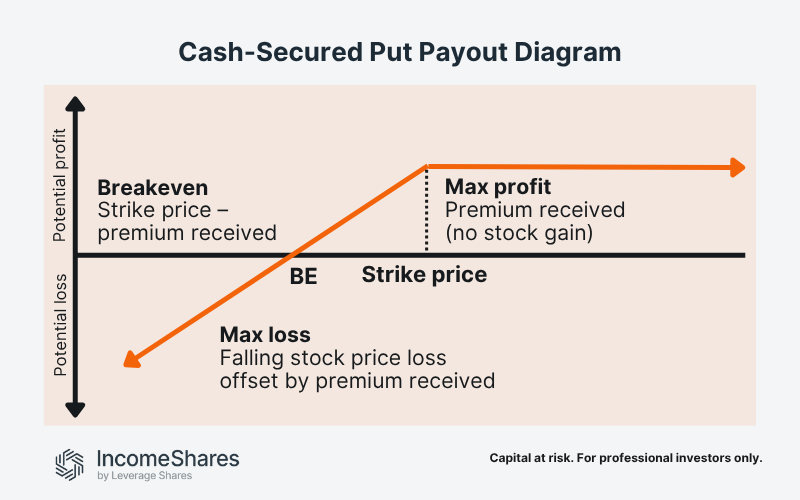

Here’s how the potential payout structure works for a cash-secured put:

Maximum profit: the premium received (if the stock stays above the strike).

Breakeven point: the strike price minus the premium received.

Maximum loss: the stock could fall to zero, but the loss is offset slightly by the premium.

The payout diagram for a cash-secured put is nearly identical to that of a covered call. The only differences are the direction of the setup (put vs call) and the capped upside. A covered call earns stock gains up to the strike, while a cash-secured put does not benefit from price appreciation.

Cash-secured puts tend to work best in flat or gradually falling markets – especially when investors might be happy to own the stock at a lower entry price.

How are covered calls and cash-secured puts similar?

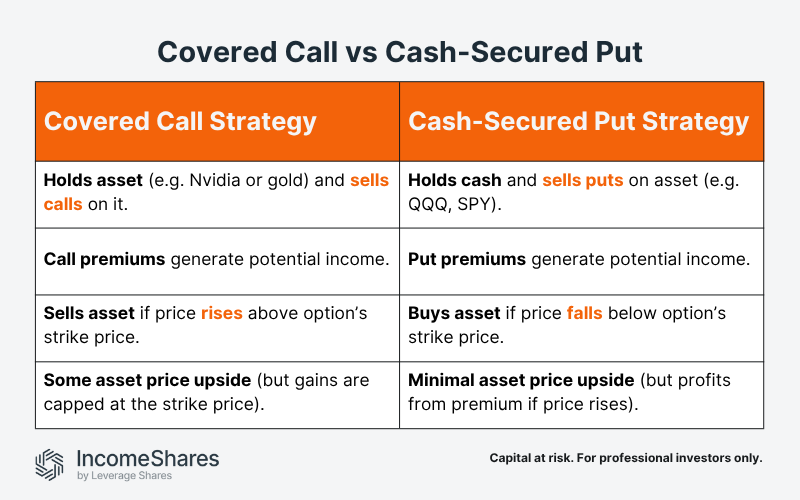

Apart from having similar looking payout diagrams, both options strategies:

Aim to generate income.

Involve selling options to collect a premium up front.

Can limit your upside and expose you to downside if the stock (or underlying asset) drops.

They’re both used in IncomeShares products, depending on the asset class and market conditions.

Hypothetical examples: side-by-side

Covered call: You own a stock trading at $100. You sell a $105 call and earn a $2 premium. If the stock stays below $105, you keep the share and the $2. If it rises above $105, you may sell the stock at $105 and still keep the premium.

Cash-secured put: You don’t own the stock, but you sell a $95 put and hold $95 in cash (enough to buy the share). If the stock stays above $95, you keep the $2 premium. If it drops below $95, you may buy it — still keeping the income.

Key takeaways

Covered calls and cash-secured puts both generate income by selling options.

The main difference is whether you hold shares (calls) or cash (puts).

Both are used in IncomeShares products depending on market conditions and the asset.

Your capital is at risk if you invest. You could lose all your investment. Please see the full risk warning here.

Related Products:

Strategy

Cash-Secured Put + Equity

Distribution Yield

42.16%

Strategy

Basket of Income-generating ETPs

Distribution Yield

49.20%

Strategy

Covered Call

Distribution Yield

11.83%

Strategy

Covered Call

Distribution Yield

17.54%

Strategy

Cash-Secured Put + Equity

Distribution Yield

130.03%