.webp)

Author

Jonathan Hobbs, CFA

Date

04 Nov 2024

Category

Market Insights

Put Options Explained: Benefits, Risks, and Examples

Your capital is at risk if you invest. You could lose all your investment. Please see the full risk warning here.

In our last guide, we explored call options. Now, let’s examine another useful tool in an investor’s arsenal: put options. Put options, like call options, are contracts that offer investors unique opportunities to manage risk and potentially profit in different market conditions. In this guide, we’ll unpack how put options work, their potential benefits and risks, and how to use them in your strategy.

What’s a Put Option?

A put option is a financial contract that gives the buyer the option to sell an asset at a pre-agreed price (the strike price) on or before a specific date (the expiration date). The buyer pays a premium to the seller for this right.

Let’s break down the parties involved:

Put option buyer: The buyer has the option (but not the obligation) to sell the asset at the strike price.

Put option seller: The seller must buy the asset from the buyer at the strike price if the buyer chooses to exercise their option. The seller earns the premium as compensation for taking on this obligation.

As with call options, the underlying asset of a put option can be anything from a stock to a cryptocurrency.

Why Use Put Options?

Here are a few ways that investors might use put options in their strategies:

Hedging: Put options can act like insurance for your portfolio, protecting you from potential losses if the price of an asset you own falls.

Speculation: If you believe the price of an asset will go down, you can buy put options to potentially profit from that drop.

Income generation: Selling put options allows investors to collect premiums, generating income even if the asset’s price stays flat or hardly moves.

Buying a Put Option: Example

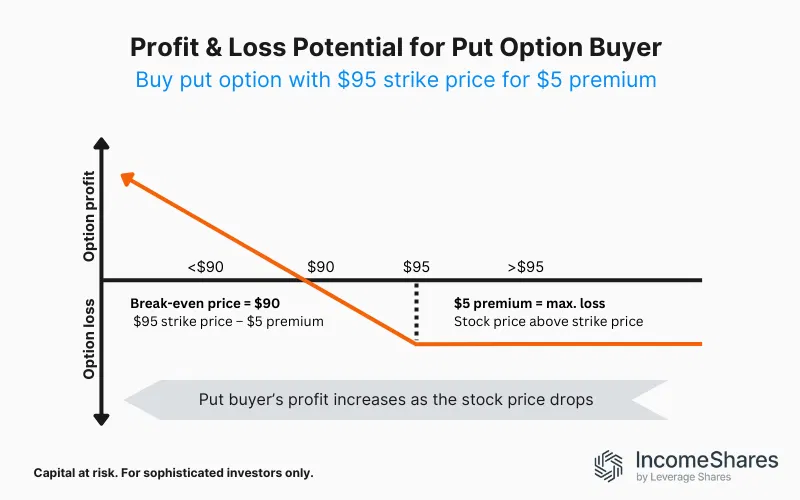

Assume a stock is currently trading at $100 per share, and you believe its price will fall. You decide to buy a put option with a strike price of $95, paying a $5 premium for the option. Let’s consider the possible outcomes:

Profit scenario – The stock price falls below $95: If the stock price drops below $95, you can buy the stock at the market price and immediately sell it for $95 using your put option. Your profit will be the difference between the strike price and the market price, minus the premium you paid.

For example, if the stock price falls to $85, you can buy it for $85 and sell it for $95, making a $10 profit per share. After subtracting the $5 premium you paid upfront for the option, your net profit would be $5 per share.

In theory, the stock price could fall to zero before the expiration date. In that case, your maximum theoretical gain would be $90 per share – i.e. the $95 strike price minus the $5 premium you paid for the put option. But in reality, if the stock price went to zero, it might be due to bankruptcy or market suspension. So, you might struggle to book that full $90 profit.

Break-even scenario – The stock price reaches $90: If the stock price falls to $90, your profit from exercising the option will exactly offset the premium you paid. In this case, you would break even.

Loss scenario – The stock price stays above $95: If the stock price remains above $95, your put option will expire worthless. Your maximum loss would be the $5 premium you paid for the option.

Selling a Put Option: Example

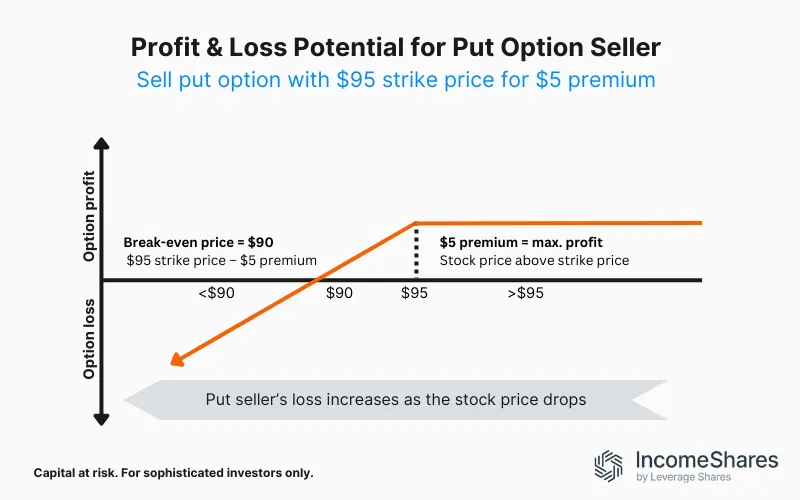

Now, let’s consider the perspective of the put option seller. The seller believes the stock price will not fall below $95 before the option expires. They receive a $5 premium for selling you the put option. Here’s what could happen:

Profit scenario – The stock price stays above $95: If the stock price remains above $95, you (the buyer) won’t exercise the put option – so the seller won’t need to sell you the stock. In that case, the seller keeps the entire $5 premium they received, realizing their maximum potential profit.

Break-even scenario – The stock price reaches $90: If the stock price drops to $90, you would likely exercise your put option. The seller would then be obligated to buy the stock from you for the $95 strike price. Now, the seller would be short $5. But the $5 premium the seller earned would offset this loss, so the seller would break even on the trade.

Loss scenario – The stock price falls way below $95: If the stock price falls sharply below $95, you would definitely exercise your put option to sell the stock. The seller would then have to buy the stock at $95, even though its market value is much lower.

For the put option seller, the worst-case scenario would be if the stock price crashed to zero before the contract expired. In that case, the seller would have to buy a worthless stock for $95 per share. After pocketing the $5 premium as a consolation, they’d be down $90 per share – in theory, at least.

Put Option Buyer vs. Seller: Risk and Reward

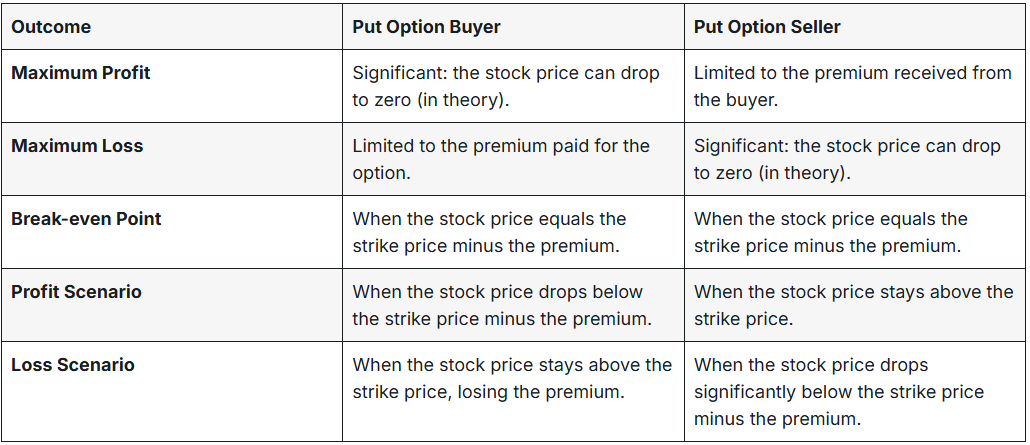

The table below summarizes the possible outcomes for the put option buyer and seller:

So, to summarize:

Buying a put:

- Limited risk: Your loss is capped at the premium paid.

- Significant profit potential: Your gains increase as the stock price falls, with maximum profit if the stock price drops to zero (in theory).

- Ideal for downward price movements: This strategy works if you expect the stock price to drop.

Selling a put:

- Limited profit: Your maximum profit is the premium received.

- Large but not unlimited risk: If the stock price drops significantly, your losses can grow, but they are capped at the strike price minus the premium received.

- Ideal for flat or upward markets: You benefit from premium income if the stock price stays above the strike price.

Key Takeaways

- Put options give buyers the right to sell an asset at a fixed price on or before a set date.

- Buying a put option allows for potential profit if the asset’s price drops. The buyer’s maximum loss is limited to the premium paid.

- Selling a put option generates premium income for the seller. However, the seller could lose big if the asset’s price drops significantly.

Your capital is at risk if you invest. You could lose all your investment. Please see the full risk warning here.

Related Products:

Strategie

Barbesicherte Puts + Eigenkapital

Ausschüttungsrendite

71.03%

Strategie

Barbesicherte Puts + Eigenkapital

Ausschüttungsrendite

47.27%