.webp)

Auteur

Jonathan Hobbs, CFA

Date

06 Nov 2024

Catégorie

Market Insights

0DTE Put-Write Strategy Explained: Income Investor’s Guide

Votre capital est exposé à un risque si vous investissez. Vous pouvez perdre la totalité de votre investissement. Veuillez consulter l’avertissement complet sur les risques ici

The 0DTE (zero days to expiration) put-write strategy is gaining popularity among income-seeking investors. In this guide, we’ll explain how it works – along with its risks and potential benefits.

What’s a 0DTE Put-Write Strategy?

A 0DTE put-write strategy involves selling a put option that expires the same day it’s written. This short-term income-generating strategy looks to take advantage of the rapid drop in an option’s value as it nears expiration – a process called time decay.

Here’s how the 0DTE put-write strategy works:

The put-writer sells a put option: The seller (or “put-writer”) sells a put option on an underlying asset (like the S&P 500 index). The put-writer earns an upfront fee (the premium) for selling the option, but this comes with a conditional obligation. If the asset drops below a specific price point (the strike price), the put-writer could lose money.

That’s because the put-writer would now be obligated to buy the underlying asset for the strike price. And the strike price would be higher than the actual price of the asset.

The put-writer sets aside cash in case they need it: The seller holds enough cash to make sure they can afford to buy the asset if the buyer exercises the put option. This risk management strategy is known as a cash-secured put.

Why Use a 0DTE Put-Write Strategy?

The point of this strategy is to earn daily income from selling put options.

Since the options expire on the same day, there’s less time for the price of the underlying asset to move below the strike price. This rapid “time decay” raises the probability of the option not being exercised by the option buyer. So, there’s a better chance that the put-writer will keep the premium as profit – without needing to buy the underlying asset.

The 0TDE put-write strategy tends to work best when market conditions are stable (i.e. less volatile). If volatility picks up, there’s more chance that the asset’s price will move below the strike before the end of the day. In that case, the put-writer will need to buy the underlying asset for a loss.

Example: 0DTE Put-Write Strategy

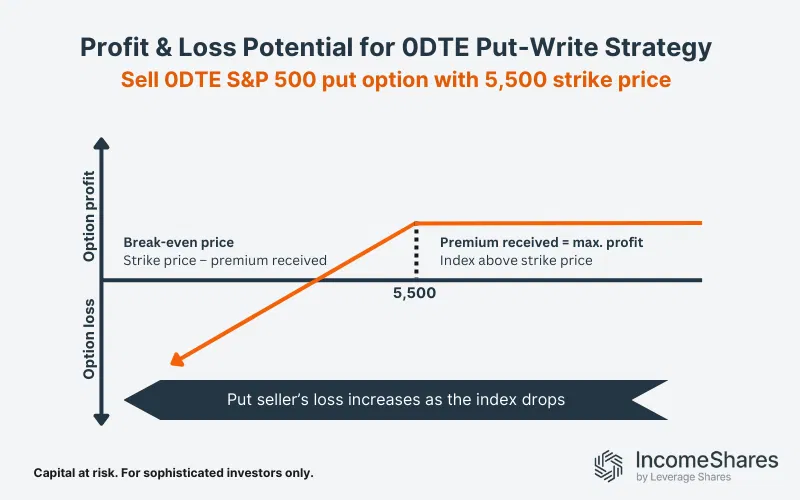

You sell an 0DTE put option on the S&P 500 index, with a strike price of 5,500. The current value of the index is 5,520 points, and you collect a $10 premium per share.

Profit scenario – The market rises or stays above the 5,500 strike price. If the S&P 500 closes above the strike price, the buyer won’t exercise the option. So, you keep the $10 premium as profit. You don’t need to buy the index, and your cash stays intact.

Loss scenario – The market falls below the strike price. If the S&P 500 heads below the strike price before the end of the day, the buyer would likely exercise the put option. You would then be obligated to buy the index for the higher strike price. The more the index drops, the bigger your loss.

Strategy Risks vs. Benefits

The main risk with the 0DTE put-write strategy is that the market drops below the strike price. If this happens, you’ll be forced to buy the underlying asset at the higher strike price. And this can lead to a potential loss. Market volatility can also amplify this risk, especially if prices swing significantly intraday.

On the flip side, daily premiums can help offset some of the downside. But keep in mind that this strategy has limited upside. You only profit from the premium – not the asset’s price increase.

Here are the potential benefits:

Daily income generation: You can earn premiums from options that expire on the same day, allowing for potential daily income.

Time decay is on your side: The rapid value loss (time decay) means you have a higher probability of keeping the premium as profit.

See our Income Guide PDF for a more detailed breakdown of how we use 0DTE put-write strategies in our ETPs (exchange-traded products).

Key Takeaways

- The 0DTE put-write strategy can generate daily income by selling options that expire the same day. The strategy benefits from rapid time decay.

- It’s a cash-secured approach where you hold cash to cover a potential asset purchase if the option is exercised.

- The 0DTE put-write strategy offers premium collection. But the risks can be high if the market drops sharply during the day.

Votre capital est exposé à un risque si vous investissez. Vous pouvez perdre la totalité de votre investissement. Veuillez consulter l’avertissement complet sur les risques ici

Produits associé:

Stratégie

Option de vente couverte par liquidités + actions

Rendement des

distributions

38.72%