Author

Jonathan Hobbs, CFA

Date

28 Mar 2025

Category

Market Insights

How a Covered Call ETP Works: Tesla Stock Example (TSLA)

Your capital is at risk if you invest. You could lose all your investment. Please see the full risk warning here.

Covered call ETPs (exchange-traded products) offer an alternative way for investors to generate income potential from stocks. But how do they actually work? This article walks through a simple, hypothetical example using Tesla (TSLA) stock.

The covered call setup

Assume an ETP uses a covered call strategy on Tesla stock (TSLA). That means the ETP holds Tesla shares and sells call options on that stock to generate potential income.

Let’s say TSLA is trading at $250. Also assume the ETP sells a one week call option on the stock with a $262.50 strike price. That strike is 5% above the current price – meaning the option is 5% “out-of-the-money.”

By selling the call option, the ETP collects $5 in premium income per share. This is the potential income the strategy aims to generate for investors.

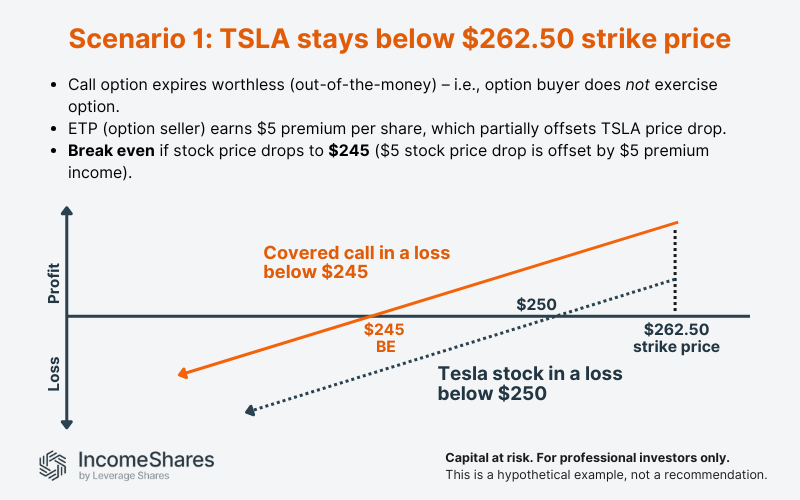

Scenario 1: Tesla stays below the strike price

If Tesla’s share price stays below $262.50 when the option expires, the option buyer won’t exercise the call. So now, the ETP keeps the $5 premium and the Tesla shares.

This outcome tends to be ideal for income generation. The premium may also help cushion any drop in the stock price. For example, if Tesla falls to $245, the $5 premium offsets the $5 price drop. And in that case, the covered call position breaks even (despite the stock having a $5 loss).

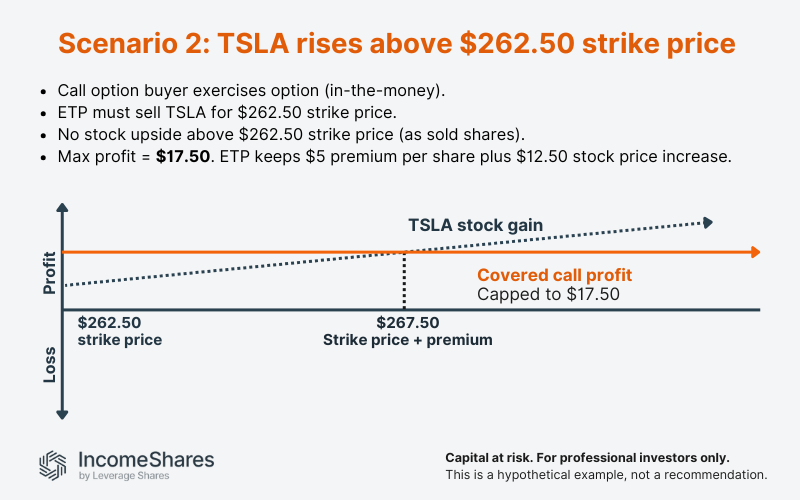

Scenario 2: Tesla rises above the strike price

If Tesla rallies past $262.50, the call option is “in-the-money” for the option buyer. So as the option seller, the ETP must now sell the TSLA shares at the $262.50 strike price.

Since the ETP sells those shares, its upside is capped beyond that level. But the strategy still profits from the stock’s $12.50 gain (from $250 to $262.50), plus the $5 premium income. All in all, the maximum profit is $17.50 per share.

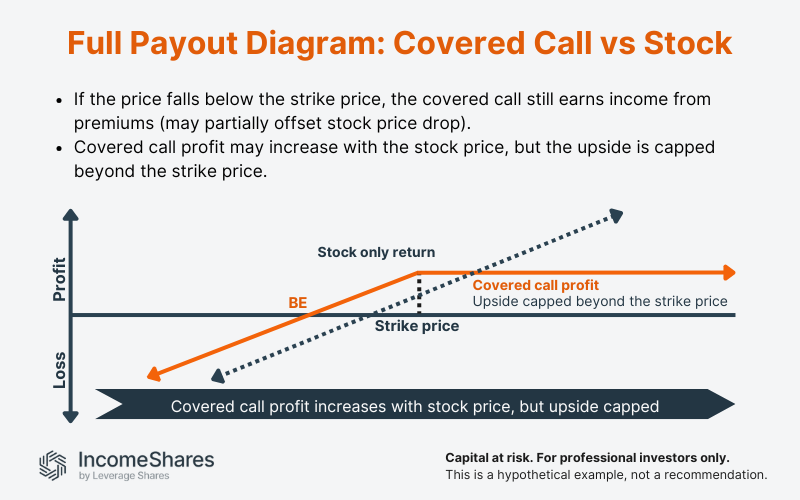

Full payout diagram: stock vs. covered call ETP

The chart below shows how the covered call strategy compares to just holding a stock.

If the stock drops, the covered call still earns premium income. That may help soften losses.

If the stock rises, the covered call gains too – but only up to the strike price. After that, any extra upside belongs to the call option buyer (and not the options ETP).

This creates a different return profile: potentially lower risk in down or sideways markets, but capped gains in rising markets.

A covered call strategy on Tesla (or any single stock) may suit investors who want to earn income while still participating in some upside. These strategies can be useful in flat or moderately bullish markets.

But they’re not for everyone. Covered call strategies won’t capture all the gains in a big rally. And investors are still exposed to stock-specific risks.

As always, total returns will depend on market conditions, volatility, and how the stock performs.

Key takeaways

Covered call ETPs aim to generate income by selling call options on stocks they already hold – like Tesla in this example.

Premium income from selling call options may help reduce downside risk if the stock price drops.

Covered call upside is capped beyond the strike price. So, the strategies may suit investors looking for income rather than full growth exposure.

Your capital is at risk if you invest. You could lose all your investment. Please see the full risk warning here.

Related Products:

Strategy

Cash-Secured Put + Equity

Distribution Yield

60.83%