.webp)

Author

Jonathan Hobbs, CFA

Date

12 May 2025

Category

Market Insights

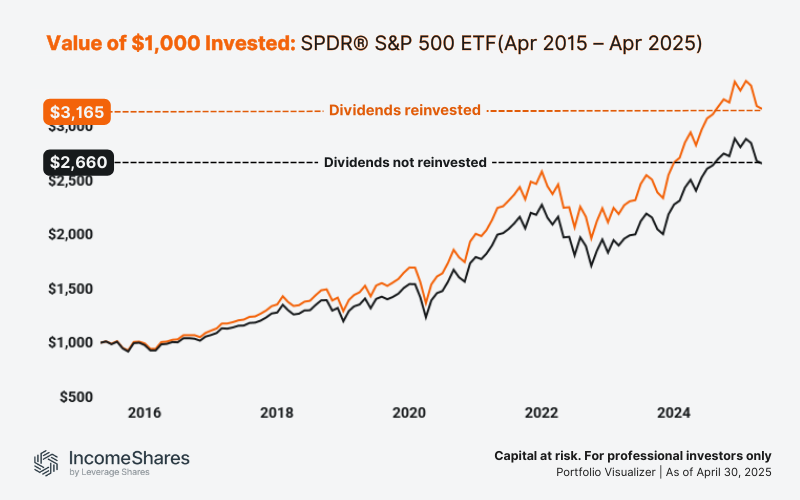

Reinvesting Dividends Makes a Difference

Your capital is at risk if you invest. You could lose all your investment. Please see the full risk warning here.

Most investors know that dividends matter. But what’s less obvious is just how much difference reinvesting them can make over time. Take the SPDR® S&P 500 ETF Trust (SPY). It’s one of the most widely held ETFs in the world, tracking the performance of the S&P 500 Index.

Example: Dividends reinvested vs not reinvested in the SPY

Between April 2015 and April 2025, if an investor simply held the SPY without reinvesting dividends, it returned 10.30% per year – turning $1,000 into $2,660.

With dividends reinvested, the return rose to 12.20% per year – growing that $1,000 to $3,165 (source: Portfolio Visualizer).

Why this matters for income strategies

This shows the power of compounding. Each reinvested dividend bought more shares, which then earned more dividends – creating a snowball effect.

For income-focused investors, it also illustrates a potential trade-off: spending the income may reduce long-term total returns.

The IncomeShares approach

The IncomeShares S&P 500 Options (0DTE) ETP (SPYY) aims to generate monthly income by selling daily put options on the S&P 500 Index or the SPY ETF. That income is not automatically reinvested back into the ETP.

Key takeaways

- Reinvesting dividends may boost long-term returns through compounding.

- Income strategies like SPYY aim to pay out monthly income – and do not automatically reinvest income.

- Income-focused strategies may involve trade-offs between regular payouts and long-term growth.

Your capital is at risk if you invest. You could lose all your investment. Please see the full risk warning here.

Related Products:

Strategie

Barbesicherte Puts + Eigenkapital

Ausschüttungsrendite

38.72%