Author

Jonathan Hobbs, CFA

Date

05 Dec 2024

Category

Market Insights

What Are Options ETPs and How Do They Work?

Your capital is at risk if you invest. You could lose all your investment. Please see the full risk warning here.

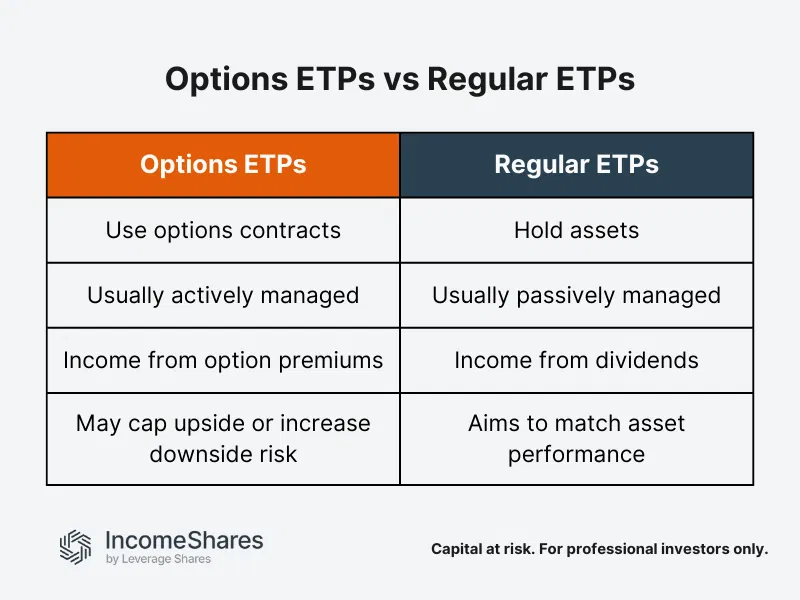

Options ETPs are a type of exchange-traded product (ETP) that use options strategies to try and generate income, manage risk, or offer exposure to specific market movements. But what are ETPs, and how do options ETPs work? This guide breaks it down.

What are ETPs?

ETPs (exchange-traded products) are investments that trade on stock exchanges, like shares. They’re designed to track the performance of an underlying asset or strategy. So, they can give investors access to a market or strategy without directly owning the underlying assets.

ETPs can hold stocks, bonds, commodities, or, in the case of options ETPs, options contracts. The key advantage of ETPs is their simplicity – you can potentially buy or sell them during market hours, just like regular stocks.

What are options ETPs?

Options ETPs use options strategies instead of just holding traditional assets. Rather than buying shares outright, these products might sell call options, write put options, or use more complex combinations to achieve their goals.

Here are two examples of common options ETP strategies:

A covered call options ETP might hold shares of Tesla stock and sell call options on those shares. The strategy could potentially earn income (options premiums) from selling the calls. But if the stock price rises sharply, the upside could be capped.

A cash-secured put options ETP might sell put options on Tesla stock to try and generate income. As part of the strategy, it will hold enough cash to buy the stock if the put option is exercised.

Options ETPs are usually actively managed, especially those using daily strategies like 0DTE (zero days to expiration). These frequent adjustments aim to maximize income or control risk.

Why do investors use options ETPs?

Options ETPs can appeal to investors seeking consistent options income. They can also give investors exposure to professionally managed options strategies without them having to trade options themselves. Instead, investors can access these strategies with the simplicity of a single product.

Risks to consider

While options ETPs can simplify the process, they still come with risks. Some strategies, like selling covered calls, could limit your upside potential. Others, like selling puts, can expose you to losses if the market drops significantly. And some options ETPs might use leverage or complex strategies, which can magnify losses during volatile markets.

As always, unexpected market moves can disrupt even the best-laid plans.

Key takeaways

ETPs are exchange-traded products that let investors access certain markets or strategies through a single product.

Options ETPs use strategies like selling puts or calls to potentially generate income or manage risk.

These products can simplify options trading while offering potential benefits like steady cash flow.

Investors should always consider the risks, including limited upside and market volatility.

Your capital is at risk if you invest. You could lose all your investment. Please see the full risk warning here.

Related Products:

Strategy

Cash-Secured Put + Equity

Distribution Yield

51.64%

Strategy

Cash-Secured Put + Equity

Distribution Yield

38.72%

Strategy

Covered Call

Distribution Yield

13.21%