Author

Jonathan Hobbs, CFA

Date

02 Dec 2024

Category

Market Insights

Options Vega Explained: How Volatility Impacts Option Prices

Your capital is at risk if you invest. You could lose all your investment. Please see the full risk warning here.

When you’re trading options, Vega is a critical metric. It tells you how sensitive an option’s price is to changes in market volatility – specifically, “implied volatility”. If you’ve ever wondered why option prices fluctuate even when the stock isn’t moving much, Vega is usually the answer. Here’s a breakdown of how it works and why it matters in options trading.

What is Vega in options?

Vega is one of the lesser-known yet essential “Greeks” in options trading. While Delta measures price sensitivity to the underlying asset, and Gamma tells us how fast Delta changes, Vega is all about volatility.

Vega measures how much an option’s price changes with a 1% shift in implied volatility. Implied volatility is the market’s “prediction” about an investment’s future volatility, based on current conditions. A higher Vega means the option price is more affected by these changes in implied volatility.

Here’s how it works for both calls and puts:

Call options: When implied volatility rises, the call’s price goes up. With more volatility expected, there’s a higher chance the stock will move above the strike price. In other words, the call option has a higher chance of moving “in the money” before the call option expires. And all else being equal, that increases the value of the call option.

Put options: Higher implied volatility also raises the price of put options. When the market expects more volatility, the stock has more chance of dropping below the strike price. The put option then has a greater chance of expiring “in the money”, so its value goes up.

Think of Vega as a “volatility thermometer” for options pricing. The higher the Vega, the more responsive the option price is to changes in market expectations about future volatility.

Note: the underlying asset of an option doesn’t have to be a stock — it could be an index, commodity, or other asset. Regardless of the underlying investment, the same logic still applies.

Why does Implied Volatility matter?

Implied volatility shows how the market views future stock price movements. If a stock is about to release earnings or news, implied volatility often spikes because of potential price swings. This increases the value of options on that stock. Higher implied volatility makes options more expensive because there’s an increased likelihood of substantial stock movement before expiration.

When there’s less uncertainty ahead, implied volatility tends to stabilize, and the impact of volatility on option prices drops.

Implied volatility can also change without a fundamental shift in the stock price. Market uncertainty or upcoming economic events can drive implied volatility higher, making options more expensive.

How Vega changes with Implied Volatility and time

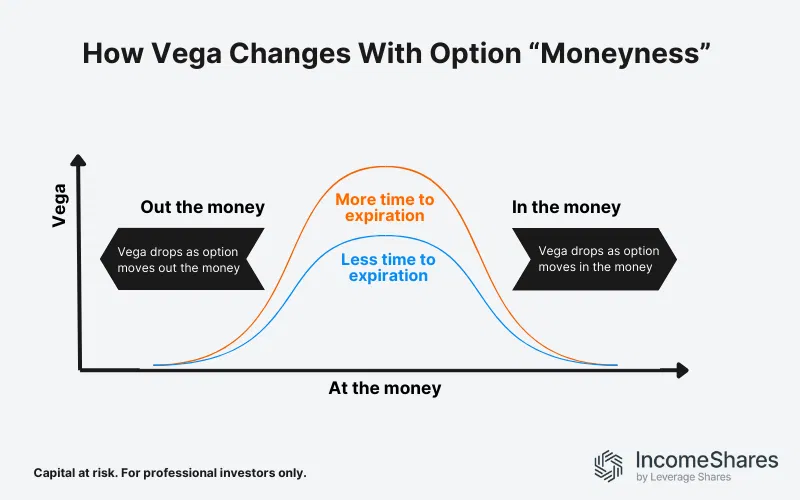

Vega is highest for options that are at-the-money (ATM) and drops as options move in-the-money (ITM) or out-of-the-money (OTM). Here’s why:

At-the-money options: These options have the most to gain from a price move, making them more sensitive to implied volatility changes.

In-the-money and out-of-the-money options: These options are less affected by shifts in volatility. They’re either already profitable or unlikely to reach profitability.

Example: How Vega impacts option prices

You own a call option on a stock with a Vega of 0.15. If implied volatility increases by 5%, the option’s price would increase by approximately $0.75 (0.15 x 5). The higher Vega means that, if volatility spikes, your option is more likely to benefit.

Key takeaways

Vega measures the option’s sensitivity to changes in implied volatility.

Higher Vega = more price impact when volatility changes, especially for at-the-money options.

Implied volatility reflects market expectations for future price moves. This can affect option prices even without a stock price change.

Your capital is at risk if you invest. You could lose all your investment. Please see the full risk warning here.

Related Products:

Strategy

Cash-Secured Put + Equity

Distribution Yield

58.42%

Strategy

Cash-Secured Put + Equity

Distribution Yield

42.69%

Strategy

Cash-Secured Put + Equity

Distribution Yield

142.78%

Strategy

Cash-Secured Put + Equity

Distribution Yield

51.64%

Strategy

Cash-Secured Put + Equity

Distribution Yield

38.72%