Author

Jonathan Hobbs, CFA

Date

02 Dec 2025

Category

Market Insights

IncomeShares Monthly Investor Update – November 2025

Your capital is at risk if you invest. You could lose all your investment. Please see the full risk warning here.

IncomeShares closed November with new highs in assets under management and cumulative fund flows. Our exchange-traded products also saw record trading turnover on the London Stock Exchange. Annualised distribution yields ranged from 10.3% to 78.8%. This update covers our numbers in more detail.

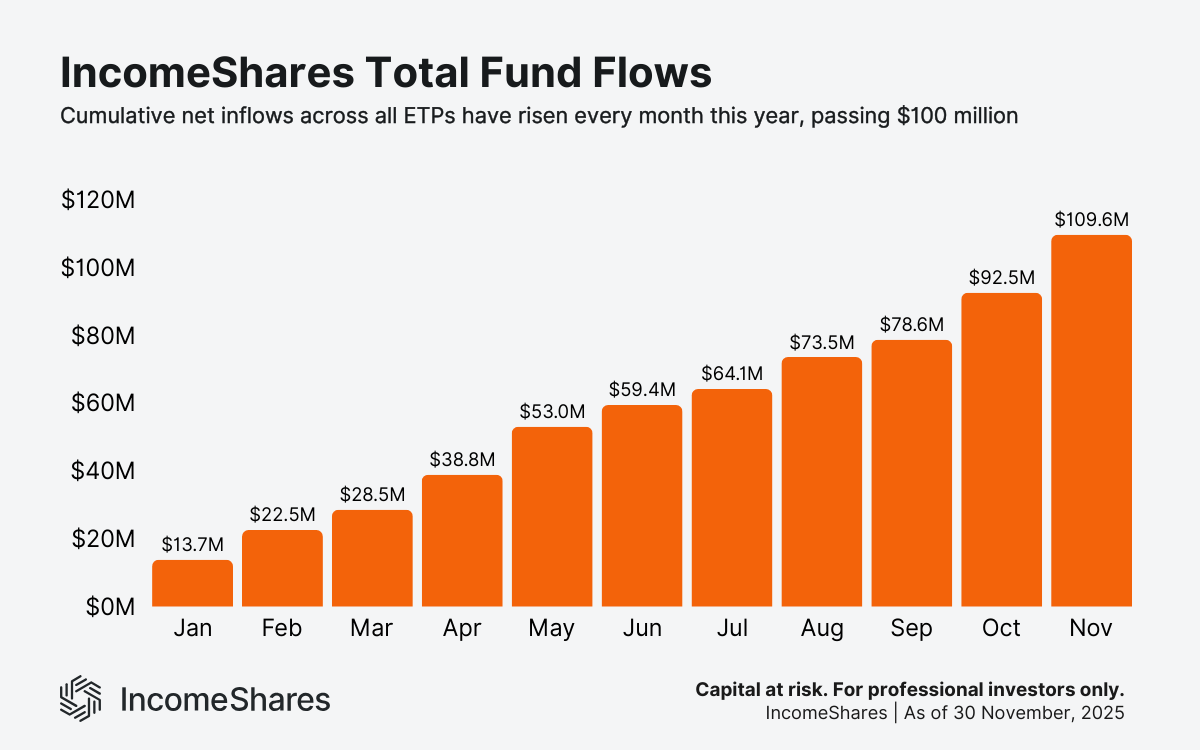

Cumulative fund flows

Sticking with the prior pattern, cumulative flows have kept rising every month of this year. November flows pushed the total to $109.6 million, up from $92.5 million at the end of October.

Investors added roughly $17 million of net new money into our ETPs in November. That’s the highest dollar amount of net inflows in a single month – and the biggest percentage increase (18.5%) since May (36.4%).

Back in May, cumulative flows first reached $50 million – so the total has more than doubled in the past six months. Consistent inflows suggest investors are allocating to option income strategies despite higher volatility and macro uncertainty heading into year-end.

Assets under management (AUM)

AUM briefly got above $100 million in the latter part of November (November 26 close, Bloomberg). But November finished just shy of that mark at $99.7 million. AUM increased 12.1% for the month – behind only October (13.3%) and May (13.8%) of this year.

As the chart shows, AUM has climbed every month in 2025 – up about sevenfold from its January base of $13.9 million. The move shows the combination of investor inflows and underlying asset movements feeding into the total. Our Gold+ Yield Options ETP now holds roughly $22.5 million in AUM – the most of any IncomeShares product.

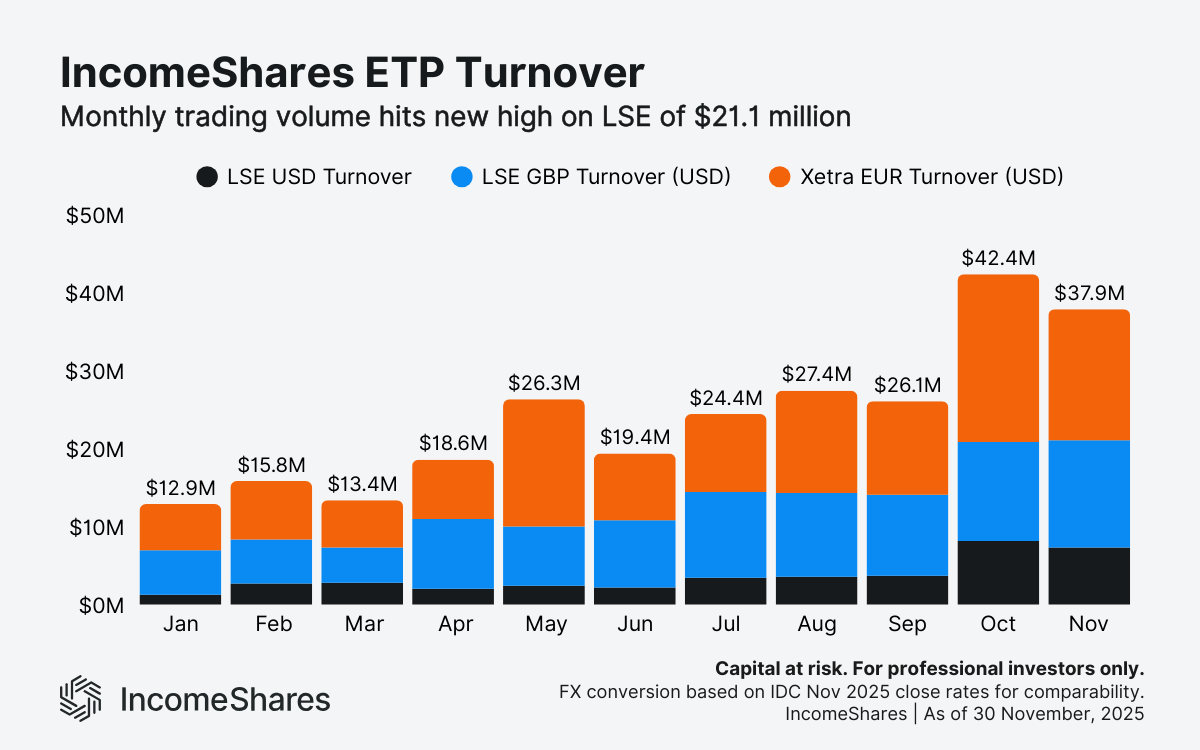

Trading turnover

November trading turnover reached $37.9 million across Xetra and the London Stock Exchange, slightly below October’s $42.4 million. That said, London turnover reached a new record of $21.1 million, just above October’s $20.8 million.

Turnover is the total dollar value of IncomeShares ETPs bought and sold on exchanges. Higher turnover typically means more activity and liquidity for investors. Note: Figures use IDC FX rates as of the November month-end to convert GBP and EUR into USD for comparison.

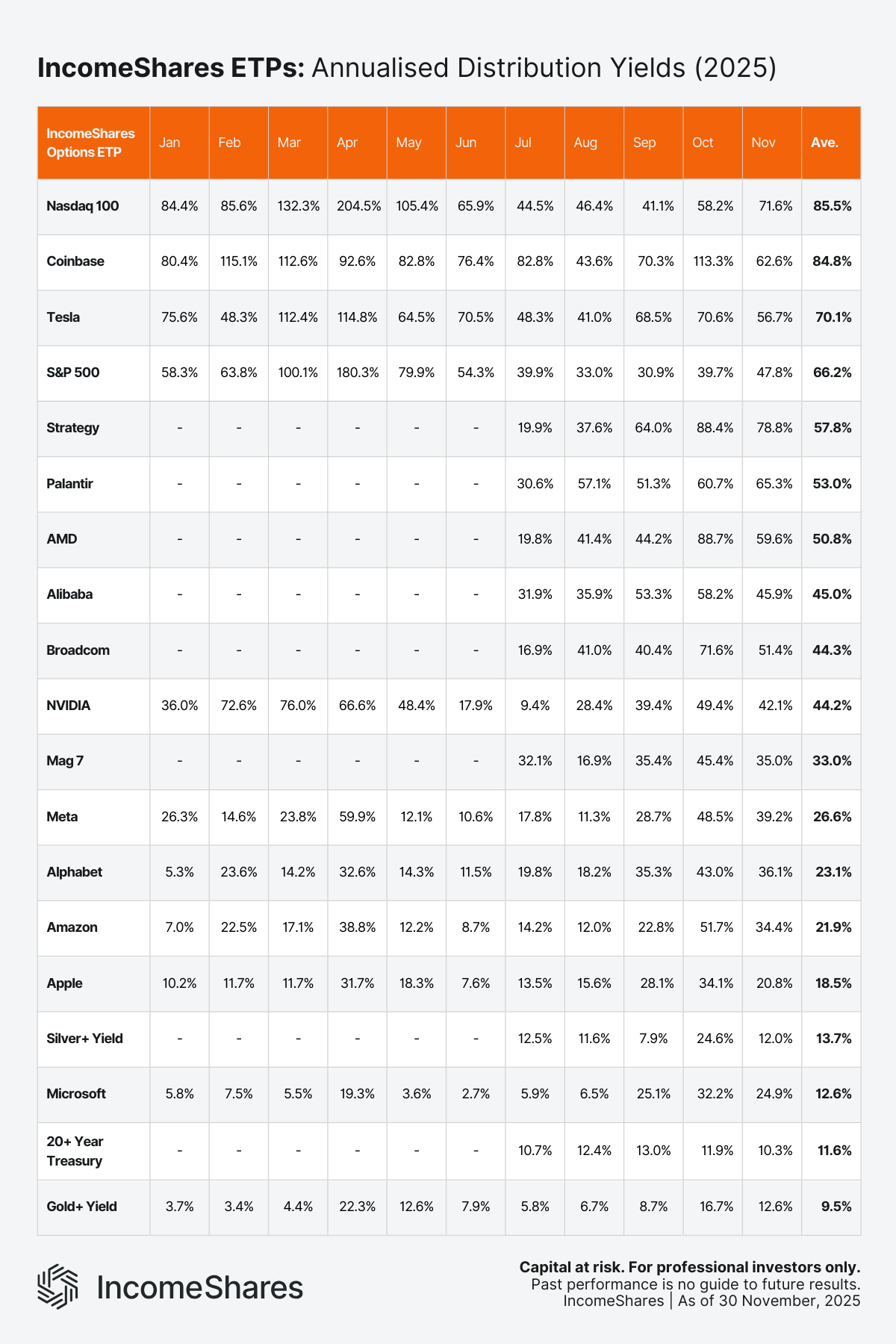

Distribution yields

Distribution yields represent the annualised income paid to investors as a percentage of an ETP’s net asset value, based on the latest month’s yield. IncomeShares ETPs aim to generate this income from selling options. Yields change each month depending on strategy performance and market volatility.

November annualised distribution yields ranked from highest to lowest:

MicroStrategy Options ETP: 78.79%

Nasdaq 100 Options ETP: 71.57%

Palantir Options ETP: 65.29%

Coinbase Options ETP: 62.60%

AMD Options ETP: 59.60%

Tesla Options ETP: 56.70%

Broadcom Options ETP: 51.40%

S&P 500 Options ETP: 47.80%

Alibaba Options ETP: 45.90%

NVIDIA Options ETP: 42.12%

Meta Options ETP: 39.20%

Alphabet Options ETP: 36.10%

Magnificent 7 Options ETP: 35.00%

Amazon Options ETP: 34.40%

Microsoft Options ETP: 24.90%

Apple Options ETP: 20.80%

Gold+ Yield ETP: 12.60%

Silver+ Yield ETP: 12.00%

20+ Year Treasury Options ETP: 10.30%

Most yields were in line with their long-run averages, helped by market volatility in November. Tesla’s yield dropped from October but still finished above 50%. Meanwhile, the more conservative commodity and fixed income strategies – Gold+ Yield, Silver+ Yield, and 20+ Year Treasury – showed lower yields.

Key takeaways

Flows: Cumulative net inflows passed $100m, ending at $109.6m, with the highest dollar amount of net inflows in a single month.

AUM: Total assets closed at $99.7m, nearly seven times January’s level.

Turnover: Trading activity stayed high at $37.9m, following October’s record.

Yields: MicroStrategy, Nasdaq, and Palantir led November’s distribution yields.

Your capital is at risk if you invest. You could lose all your investment. Please see the full risk warning here.

Related Products:

Strategy

Cash-Secured Put + Equity

Distribution Yield

79.53%

Strategy

Covered Call

Distribution Yield

12.24%

Strategy

Basket of Income-generating ETPs

Distribution Yield

43.75%

Strategy

Covered Call

Distribution Yield

12.23%

Strategy

Covered Call

Distribution Yield

12.89%

Strategy

Cash-Secured Put + Equity

Distribution Yield

65.82%

Strategy

Cash-Secured Put + Equity

Distribution Yield

116.45%