Author

Sandeep Rao

Date

03 Nov 2025

Category

Market Insights

Gold Might Be The Standout This Earnings Season

Your capital is at risk if you invest. You could lose all your investment. Please see the full risk warning here.

Earlier in August this year, CNBC reported Pitchbook data1 indicating that the ratio of private equity (PE) investments to exits has jumped from 2.6x in 2024 to 3.14x in 2025, the highest in a decade. PE funds typically have a finite duration of 10 years; when they're unable to sell their stake, these become "zombie funds" wherein companies' stakes essentially sit around unsellable. According to PitchBook, 54.7% of all active PE funds globally are now six years or older, higher than the 52.2% at the end of 2024 — a sign that fund timelines are stretching well past the norm.

Asset manager Coller Capital – which manages $33 billion in a market wherein existing stakes in PE and other alternative investment funds are bought and sold, thus making it one of the largest such firm in the world – sounded the alarm in June last year2 when it released a survey made among 110 private equity investors (also known as limited partners) in North America, Europe and Asia. In this survey, 50% of pension funds, insurers or other investors reported having money in "zombie funds", i.e. funds that have little hope of liquidating their assets or raising a successor vehicle while 28% expect to see such "zombie funds" appear in their portfolio.

Not all "zombies" are privately-owned. As early as 2022, Goldman Sachs estimated3 that nearly 13% of all publicly-traded U.S. companies were "zombies", i.e. "firms that haven’t produced enough profit to service their debts.". Deutsche Bank – analyzing 2020 data – estimated that over 25% of all U.S. companies were "zombies", up from only 6% in 2000.

The "zombies" were the result of an era of "free money" created by low interest rates designed to spur spending and investment after the Great Financial Crisis (GFC) of 2008 leading to the creation of a host of enterprises unable to differentiate themselves from competitors, with poor margins, and a lack of options for future profitable growth leaning hard on an endless relay of cheap loans and stock market speculation. If interest rates are above near-zero as they have been for some years now, "zombies" would increasingly struggle to pay interest expenses.

This earnings season kicked off with JP Morgan CEO Jamie Dimon declaring in the course of his bank's call that if or when an economic downturn comes, investors should expect more companies that have taken on too much debt to go the way of First Brands – the failed auto parts supplier that had leading banks assuring investors that there is no systemic risk in their private credit books. As of 2024, private credit funds more than tripled4 over the past decade to $1.6 trillion in assets.

"My antenna goes up when things like that happen," said Mr. Dimon. "And I probably shouldn’t say this, but when you see one cockroach, there are probably more. And so we should—everyone should be forewarned on this one." While he stated that JPMorgan had no exposure to First Brands, the bank did have to write off $170 million in bad debt to car dealership company Tricolor in its latest quarter. Two days later, Zions Bancorp (ZION) and Western Alliance Bancorp (WAL) disclosed new troubles from loans they had separately extended to a group of related real estate entities.

Since banks tend to kick off the earnings season in earnest, the ongoing affordability crisis among American consumers and geopolitical upheavals from the clumsily-handled tariff war potentially affecting overseas market access for American firms have been a dampener this earnings season even for leading stocks that should have benefited from low market breadth resulting from investors blowing past overstretched enterprises to favour tech champions, as seen from the muted investor reaction to stellar results from chipmaking tool manufacturer ASML as well as foundry of choice to tech giants TSMC.

Despite a recent drop5, the standout so far this earnings season might be: gold.

Gold vs the Dollar

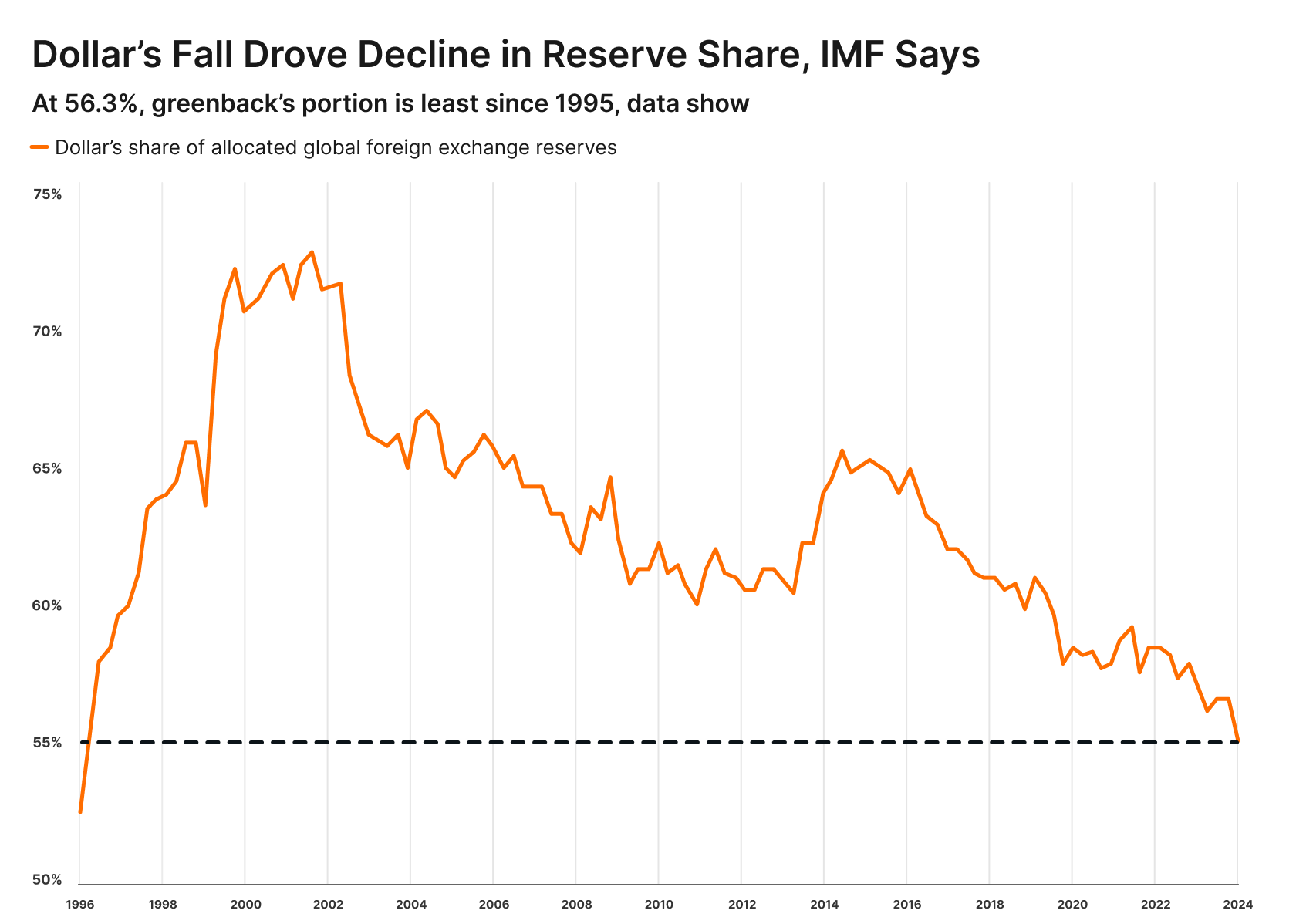

The International Monetary Fund’s Currency Composition of Foreign Exchange Reserves (COFER) report reported6 in early October this year that U.S. dollar's share in global reserves fell from the high of 71% in 1999 to 56.3% in mid-2025, the lowest level in thirty years.

Source: International Monetary Fund, Bloomberg

As per the Federal Reserve Bank of Minneapolis’ inflation calculator, $100 in 2025 has the same purchasing power as $12.05 in 1970. While ever-increasing debt issuances by successive administrations since 1970 played a role in this, what held some of the effects at bay was trade with the United States. While central banks around the world were acutely aware of the declining purchasing power of the U.S. dollar, an incentive to clear trade payments efficiently – effectively a trade liquidity aid – became the underpinnings of a decision to hold dollar assets. With the advent of "Liberation Day" tariffs7 earlier this year – along with numerous flip-flops since – and the Trump administration repeating much of the same spending patterns as with previous administrations (another flip-flop from during the campaign trail), central banks outside of the U.S. are now incentivized to return to de-dollarize – with gold emerging as a clear favourite – despite repeated threats8 of tariffs if the U.S. dollar were to be supplanted in global trade payments.

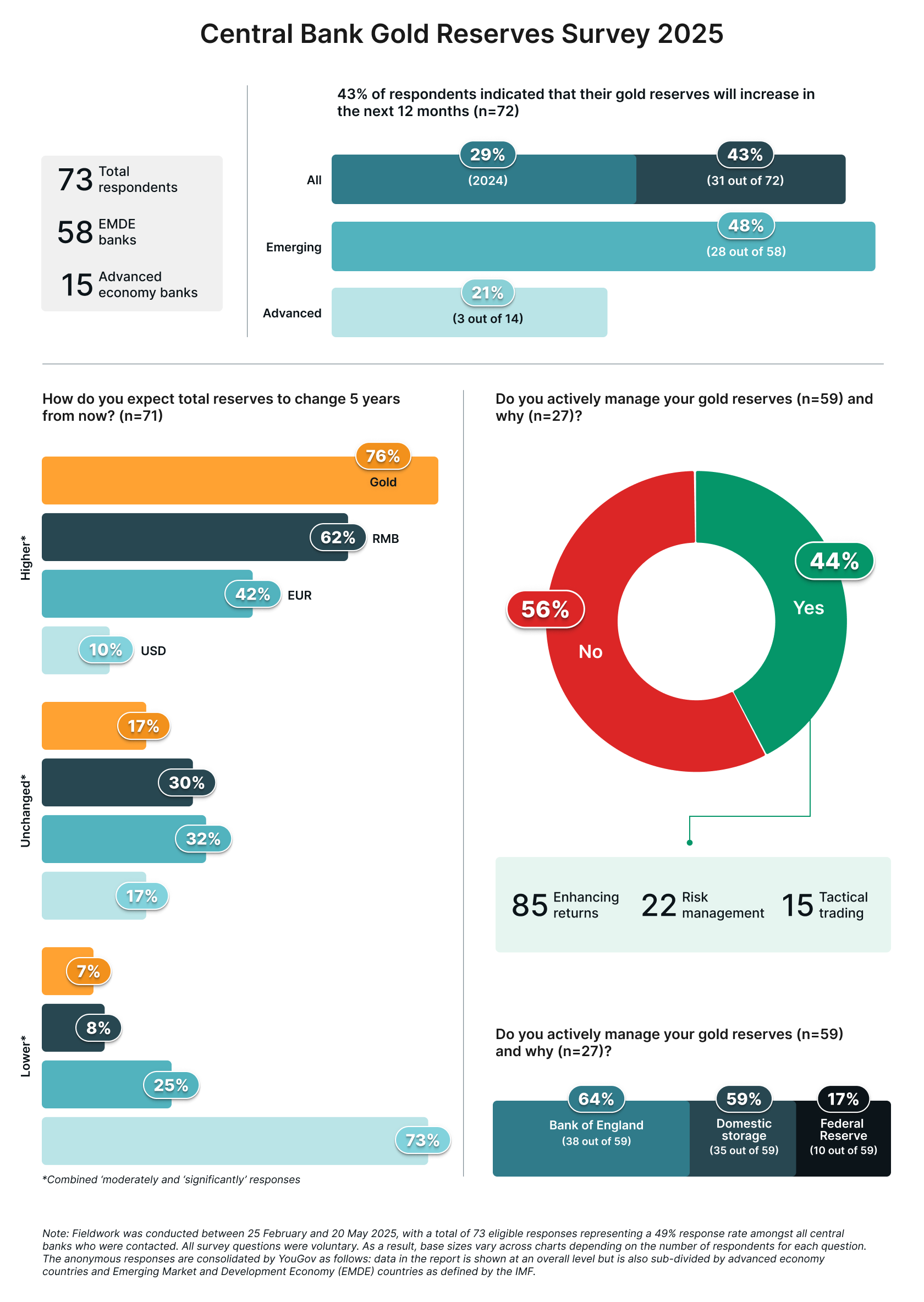

The recent "Central Bank Gold Reserves Survey" carried out9 by the World Gold Council between 25 February and 20 May this year had 73 central banks responding on a voluntary basis wherein 43% of central banks stated plans to increase their gold reserves in the next 12 months. This is the first time since the 1960s that central banks are growing their gold holdings at a faster rate than U.S. Treasuries.

Source: World Gold Council

73% also indicated that they will be "moderately or significantly" reducing their U.S. dollar reserves.

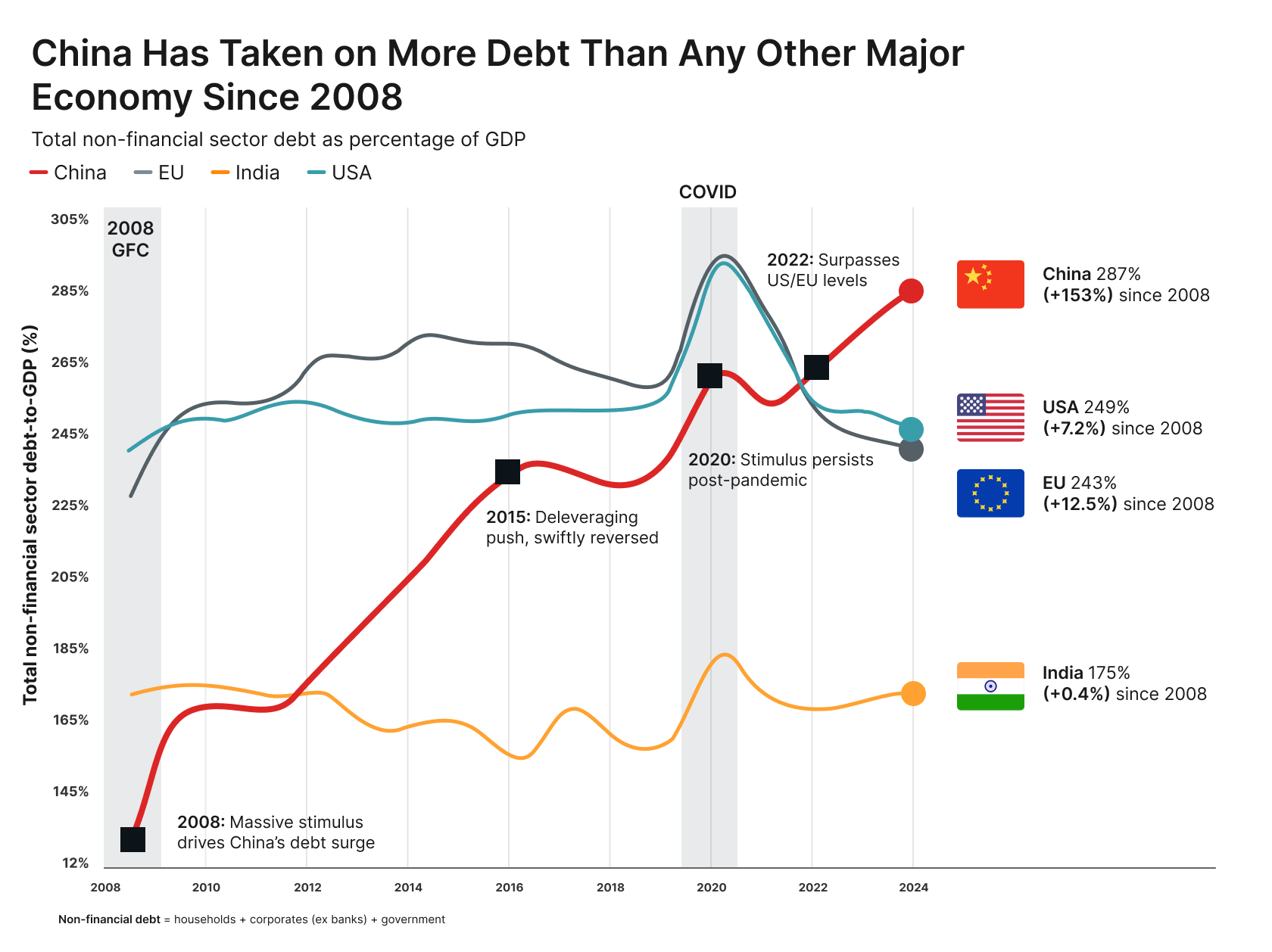

While the Euro was historically positioned as an alternative to dominance and the Chinese renminbi now sees some increasing presence in central bank vaults as a result of trade, the spectre of debt issuances diluting currency values looms large over both of them. China – generally represented as a "Developing Markets" (DM) economy – now holds a higher debt-to-GDP ratio than both the European Union and the U.S. as a result of massive stimulus packages from the last recession (in GFC-era 2008) and the pandemic.

Source: Bank of International Settlements

In contrast, India – also deemed a "DM economy" – maintains the trend typically seen in DM economies with regard to debt: expectations of higher yields on their government bonds often ensure they limit bond issuances and instead focus on building up revenues from taxes and other sources.

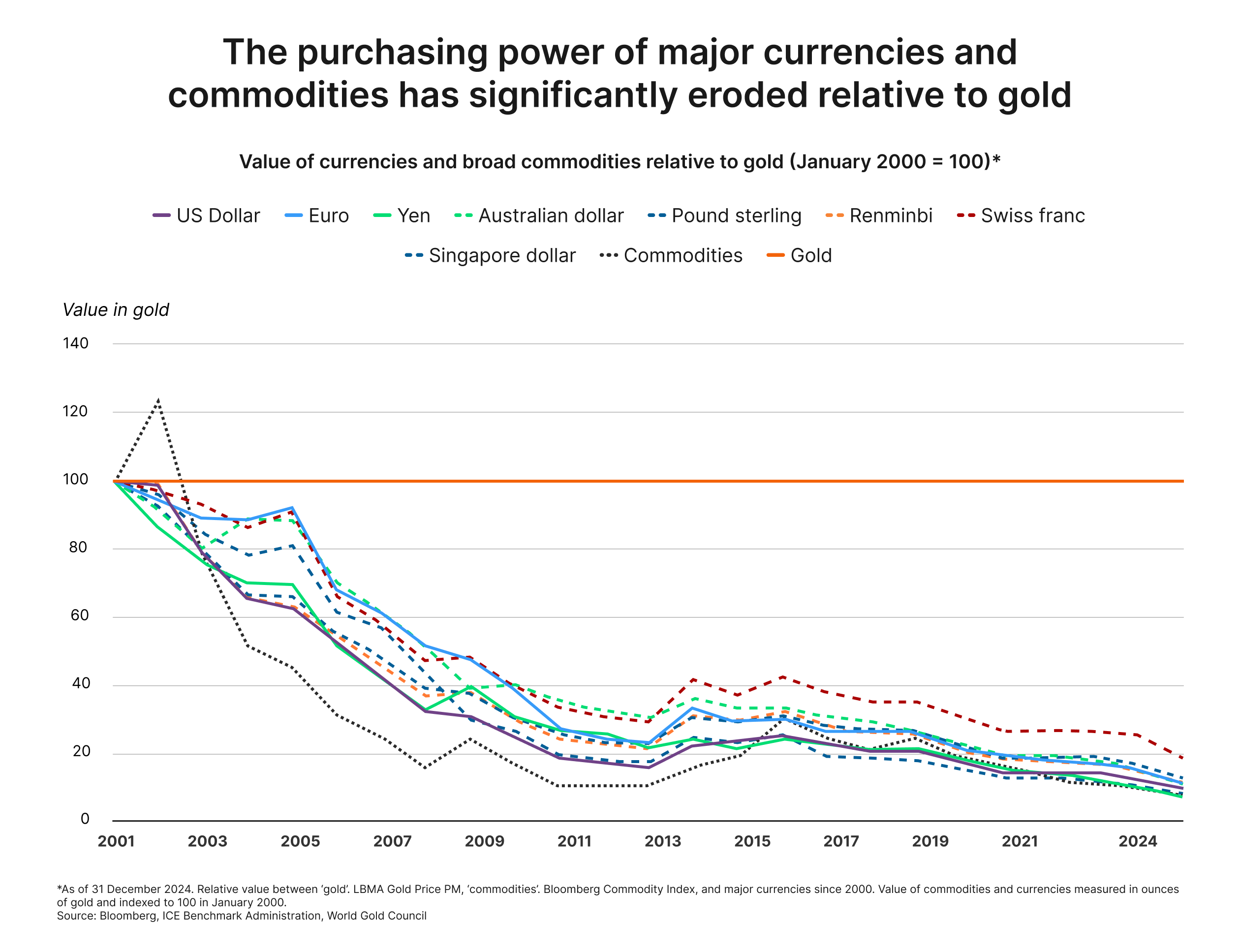

Neither the U.S. dollar nor the Euro nor the Chinese renminbi (or even the more stable currencies such as the Swiss franc or the Singapore dollar) have been able to maintain any semblance of parity with gold prices.

Source: World Gold Council

Since 2001, the U.S. dollar has lost over 85% of its value relative to gold while the Swiss franc has fared only slightly better at 80%. In June this year, Rick Rule – former president and CEO of Sprott U.S. Holdings – posited10 that the U.S. dollar's erosion is far from over, mainly on account of the fact that the net present value of unfunded federal promises (including Medicare, Medicaid, Social Security, federal pensions, military pensions and so forth) carries net liabilities on the United States past the $100 trillion mark, leading to the U.S. dollar likely losing 75% of its purchasing power over the next 10 years.

Regardless of a central bank's national affiliation, this supports the drive of central banks to stock up on gold. In 2024 alone, central bank reserves added 1,045 tonnes into their vaults, with this buying spree likely to continue in the years to come.

Outlook: Gold vs Treasuries

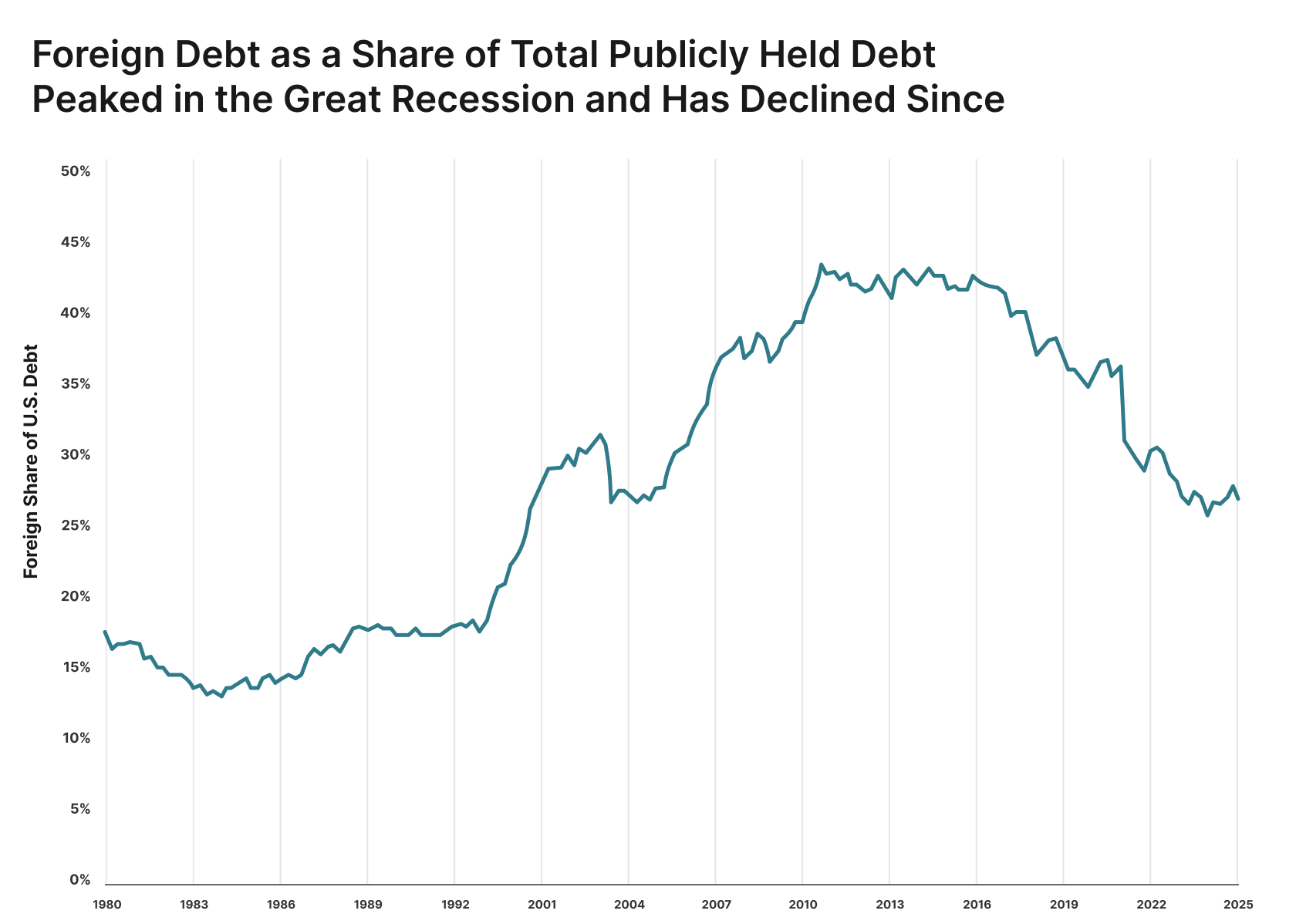

Of the $34-plus trillion in outstanding U.S. government debt, around $8.5 trillion is presently estimated11 to be held by foreign investors – both central banks and otherwise.

Source: Bipartisan Policy Center

At around $1 trillion, Japan is by far the largest holder of American debt. In the course of trade talks in the wake of the "Liberation Day" tariffs, some reports emerged that the U.S. delegation proposed to the Japanese team that its debt holdings be "re-termed" into 100-year "Century Bonds" before being hastily withdrawn from discussion. This is from the playbook of Stephen Miran, the administration's Chief Economic Advisor, wherein it was proposed that countries pay for the privilege of their association with the U.S. by "re-terming" their U.S. debt holdings. The "re-terming" proposal has been deemed to be exceedingly infeasible on a variety of factors12 – chiefly that it represents a betrayal of trust that led to the purchase in the first place and that the attractiveness of holding such instruments would be very untenable given the volatility introduced by long time horizons. However, given the administration's behaviour so far, even the infeasible could be deemed probable. If some action like this were to take place, global institutional faith in dollar assets would vanish. Even a U-turn by a successive administration would be unlikely to return this faith in short order: trust takes a long time to build but only needs a moment to be lost.

Thus, more so than ever before - and regardless of short-term trends - gold becomes more important than ever for stability-seeking investors such as central banks. On the 23rd of October, JPMorgan forecasted that gold will reach $5,055 per ounce13 by Q4 2026 – with Bank of America, Societe Generale and Goldman Sachs also forecasting similar levels.

Source: Reuters

Frank Holmes, chief executive officer and chief investment officer at U.S. Global Investors Inc. (GROW) opines14 that gold could reach $7,000 an ounce by the time Trump leaves office.

At the very least, if not an outright "buy", continuing to "hold" gold (if present) in some measure might be considered a prudent form of action for investors. Professional investors seeking to monetize on gold’s trajectory might consider the Gold+ Yield Options ETP (GLDI). The ETP holds exposure to SPDR® Gold Shares (GLD) and sells call options on that exposure to generate potential income each month from option premiums.

Footnotes

1“Private equity investors want their money back — but it’s tied up in ‘zombie funds’”, CNBC, 7 August 2025

2“Most Private Equity Investors Fear Cash Is Stuck in Zombie Funds”, Bloomberg, 11 June 2024

3“A huge number of ‘zombie’ companies are drowning in debt. This CEO sees a reckoning as interest rates soar”, Fortune, 1 October 2022

4“Private Credit Strategies: An Introduction”, Cambridge Associates, 3 May 2024

5“Stocks mostly flat but earnings a positive; gold drops 5%”, Reuters, 22 October 2025

6“Dollar Slump Puts Share of Foreign Reserves at 30-Year Low”, Bloomberg, 1 October 2025

7“"Liberation Day" Tariffs: A Long-Term Strategy?”, Leverage Shares, 8 April 2025

8“Trump repeats tariffs threat to dissuade BRICS nations from replacing US dollar”, Reuters, 31 January 2025

9“Central Bank Gold Reserves Survey 2025”, World Gold Council, 17 June 2025

10“Rick Rule warns the US dollar will ‘lose 75%’ of its buying power in 10 years", Moneywise, 17 June 2025

11“Foreign Investors Hold a Shrinking Share of U.S. Debt", Bipartisan Policy Center, 4 June 2025

12“Turning Treasury Securities into Century Bonds Is a Dead End", American Institute for Economic Research, 23 April 2025

13“JP Morgan raises gold outlook on investor interest, central bank buying", Reuters, 23 October 2025

14“Why this veteran investor sees gold hitting $7,000 by the end of Trump's term”, MarketWatch, 30 September 2025

Your capital is at risk if you invest. You could lose all your investment. Please see the full risk warning here.

Related Products:

Strategy

Covered Call

Distribution Yield

13.21%

Strategy

Covered Call

Distribution Yield

18.40%